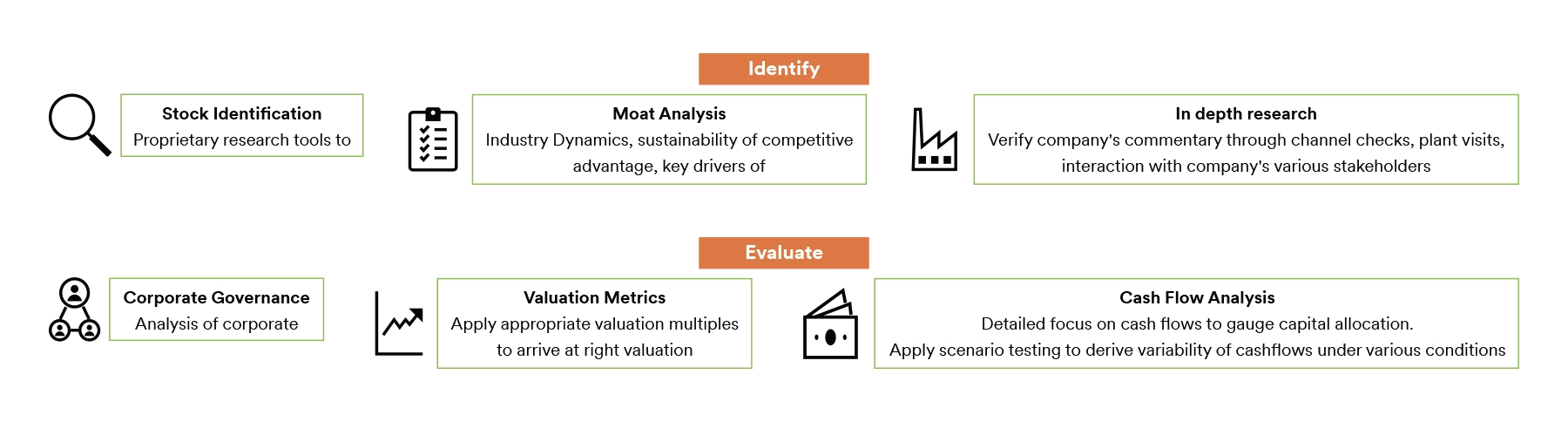

PNB MetLife Value Fund is an actively managed fund with an objective of generating wealth over the medium to long-term by investing in equities.

The fund will leverage PNB MetLife Investment team’s proven competence with regard to stock/sector selection using rigorous research capabilities and Fund will endeavour to outperform the benchmark.

The fund aims to identify companies with strong fundamentals that are trading at a price lower than their intrinsic value. By buying these undervalued stocks, value fund aims to profit as the market recognizes their true worth and the stock prices increase.

This fund’s core investment strategy is Value Investing.

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

Value investing is a time-tested strategy which delivers significant wealth creation for patient investors with a long-term horizon. Value investing primarily originated with Benjamin Graham and David Dodd, professors at Columbia Business School, in the 1920s and 1930s. Value investing emerged as a response to the chaotic and speculative nature of the stock markets in the early 20th century, providing a disciplined and rational framework for making investment decisions based on a company's true economic worth.

Historical data from NSE suggests that the value investing strategy has outperformed the broader indices in the past. From data standpoint as on 31st May 2025, NIFTY 50 has delivered 5-year CAGR returns of 20.9% whereas NIFTY 500 Value 50 Index fund has delivered a staggering 39.51% returns, clearly showcasing the huge upside of value unlocking.

Note: Benchmark returns for illustration purpose only

PNB MetLife Value Fund can be availed with ULIP Plans.

| Fund Name | PNB MetLife Value Fund |

| Benchmark | NIFTY 500 Value 50 Index |

| Fund Manager | Deb Bhattacharya |

| Fund Type | Active Fund |

| Risk Profile | Very High |

| Fund Strategy | Value Investing – An investment strategy that involves buying stocks that appear underpriced relative to their intrinsic value |

| Fund Objective | The primary objective of a value fund is to generate long-term capital appreciation by investing in stocks that are considered undervalued by the market. |

| Investment Objective | To invest in a diversified portfolio of equity securities of companies that represent excellent value relative to their current price |

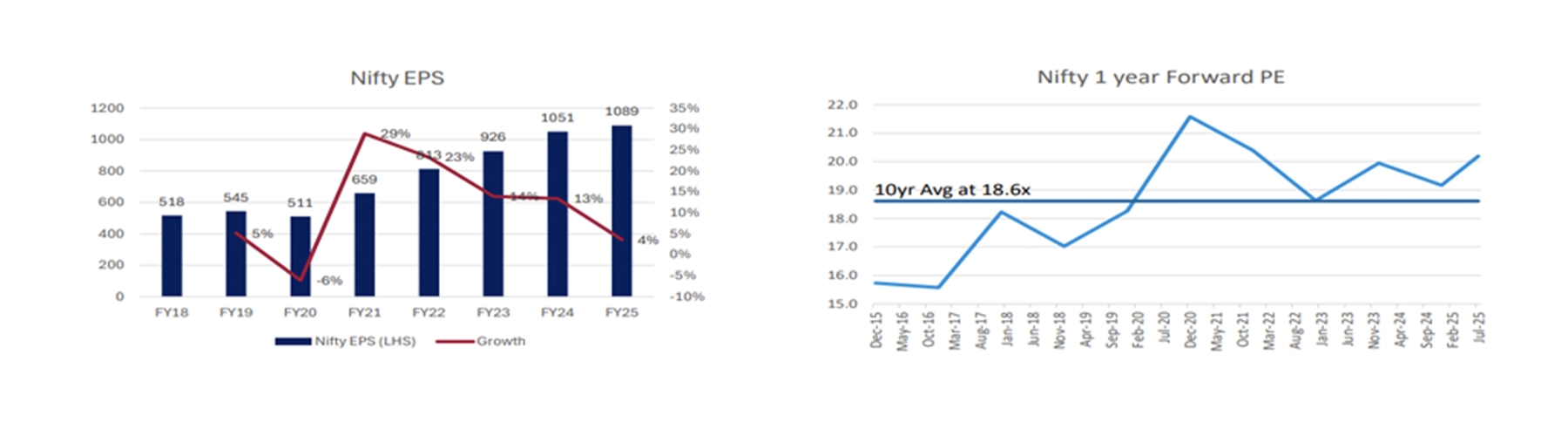

P/E Ratio = Price of Share / Earnings per Share (EPS)

EPS = Earnings of a company after tax / No. of outstanding shares.

Example: Nifty Index - 25500

Investing in a value fund offers compelling advantages for long-term investors. Discover how this disciplined approach can help grow your wealth.

Value investing focuses on buying undervalued stocks. These are companies trading below their true worth. As the market recognizes their actual value, you can see significant capital appreciation. Historically, this strategy has delivered strong long-term investment performance.

Value stocks often come from stable, established companies. Their already depressed prices make them less prone to sharp swings during market shifts. This inherent stability leads to lower investment volatility, providing a smoother path for your investment portfolio.

A core principle of value investing is the "margin of safety." This means acquiring assets at a substantial discount to their estimated intrinsic value. This discount acts as a buffer, safeguarding your investment during market downturns or unexpected company challenges. It offers a crucial layer of protection, potentially lowering your investment risk.

On availing PNB MetLife Value Fund with our ULIPs, you get Life Cover to safeguard yourself and your family against life’s uncertainties.

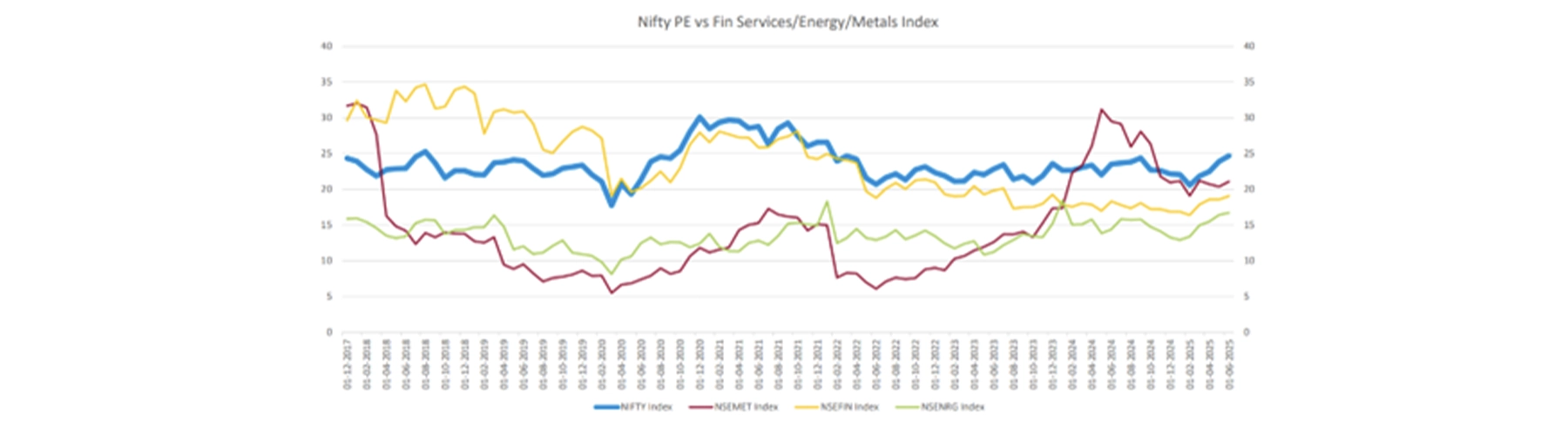

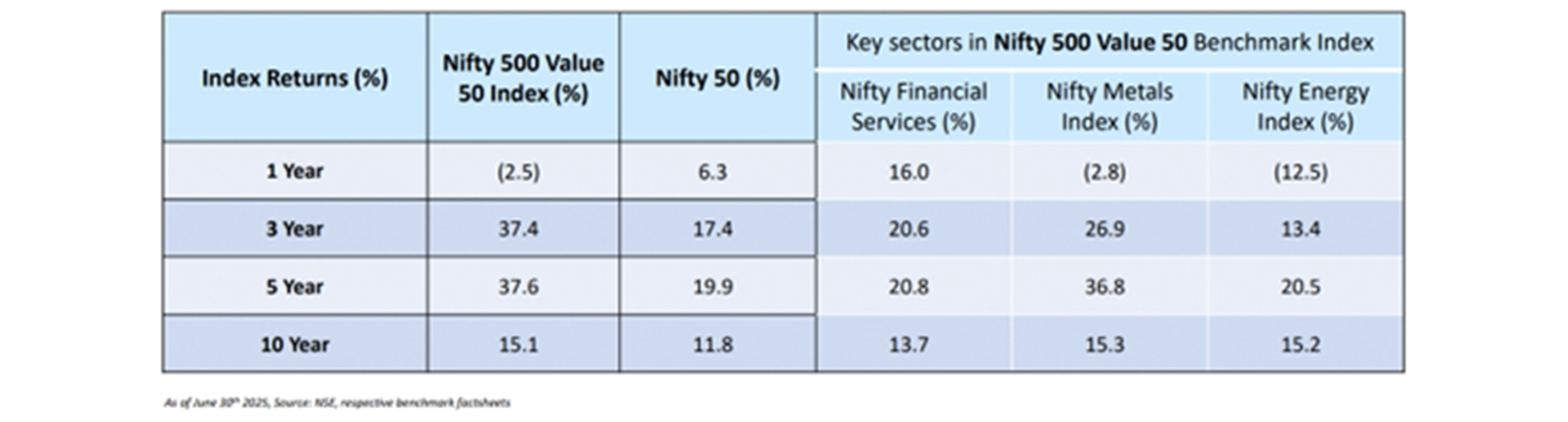

The below table shows that the NIFTY 500 Value 50 Index has delivered significantly higher returns than the overall NIFTY 50 Index, over the short as well as long terms

Note: Benchmark returns for illustration purpose only

| Equity Scheme Name | Cap | 3 Year (CAGR) | 5 Year (CAGR) | Overall Morningstar Rating1 | ||

|---|---|---|---|---|---|---|

| PMLI Returns |

Benchmark Returns | PMLI Return |

Benchmark Returns | |||

| Mid Cap | Mid Cap | 28.5% |

24.9% | 37.7% | 30.7% | ⭐⭐⭐⭐⭐ |

| CREST (Thematic) | Mid Cap | 21.0% |

16.1% | 26.6% | 21.5% | ⭐⭐⭐⭐⭐ |

| Premier Multi-Cap | Mid Cap | 19.4% |

16.8% | 27.4% | 23.6% | ⭐⭐⭐⭐⭐ |

| Multiplier III | Large Cap | 19.4% | 14.3% | 24.9% | 20.9% | ⭐⭐⭐⭐⭐ |

| Flexi Cap | Large Cap | 17.5% |

16.1% | 22.9% | 22.7% | ⭐⭐⭐⭐ |

Source: Fund factsheet

Note: As on 30th May 2025

The New fund can be availed with PNB MetLife Unit Linked Insurance Plans (ULIPs). These plans can be availed through online mode as well as offline distribution channels.

To buy online directly from the company’s website, please follow 4 simple steps:

Step 1: Click on Invest Online

Step 2: Fill in your details – Name, Mobile Number, DOB etc.

Step 3: Choose the amount to invest (premium), frequency of payment, years you want to pay for, years for which you want to stay invested, fund, fund allocation etc., and check the expected returns

Step 4: Make the payment using Net-Banking, credit/debit card, or UPI

Step 5: Fill up the proposal form containing personal information like address and other details like lifestyle, income and medical questions, nominee details etc.

Step 6: Complete the application by doing e-KYC (Aadhar) or c-KYC (PAN)

Step 7: Set up direct debit mandate / e-NACH for future premiums payment.

To meet our trusted representative, please call up at the contact centre or drop your lead at the form given below.

Please note: ₹10 NAV will be allotted to applications received between 15th July to 27th July, 2025 and issued on 28th July 2025, subject to fulfilment of all the requirements and final decisioning of the proposal by underwriting.

It is the introduction of a new fund option among the already existing options which a prospect customer can avail. In Life Insurance parlance, a fund can be availed with a Unit Linked Insurance Plan popularly known as ULIP. As the name suggests, ULIPs also offer Life Insurance Cover. ULIPs also offer tax advantages which can help you save taxes by availing exemption u/s 80C as well as u/s 10(10D).

Value investing is a fundamental investment philosophy that involves buying securities (like stocks) that appear to be trading for less than their true, underlying worth, also known as their "intrinsic value."

NAV stands for Net Asset Value. The performance of a fund is denoted by its NAV per unit. NAV per unit is the market value of securities of a scheme divided by the total number of units of the scheme on a given date.

Investment in any fund directly or indirectly depends on one’s financial goals. Like any other investment options, disciplined savings and staying invested for a long-term period often help in getting the best possible returns, as the investments made during highs & lows of the market get netted off and overall yield positive returns in the growing market trend. And this applies more so in case of Value Fund, as the unlocking of company’s true worth may take time.

Fund Value of your policy can be checked on our Khushi app or by logging into the customer portal. The performance of the each of the company’s funds can be checked on the company website https://www.pnbmetlife.com/.

PNB MetLife has been offering the life insurance solutions in India since 2001. It has a vast spread of partners and locations through which our plans are distributed across. Customers can walk-in to any of our branches for any purchase or service-related requirements. PNB MetLife also offers mobile & digital touch points – website, contact centre, mobile application, whatsapp, chatbot etc. which can be availed by the customer through the clock. PNB MetLife boasts of 99.57% Claim Settlement Ratios which is a great testimony of our service philosophy. The fund performance of PNB MetLife funds has been stellar with most funds delivering higher returns than their respective benchmark returns. PNB MetLife equity funds have been rated 4 or 5 stars by Morningstar, a reputed global financial services firm specializing in fund ratings. Hence, PNB MetLife can be considered as a good choice for your life insurance, savings and investment requirements.

THE UNIT-LINKED INSURANCE PRODUCTS DO NOT OFFER ANY LIQUIDITY DURING THE FIRST FIVE YEARS OF THE CONTRACT. THE POLICYHOLDER WILL NOT BE ABLE TO SURRENDER/WITHDRAW THE MONIES INVESTED IN UNIT-LINKED INSURANCE PRODUCTS COMPLETELY OR PARTIALLY TILL THE END OF THE FIFTH YEAR.

PNB MetLife Mid Cap Fund (SFIN: ULIF02501/01/18MIDCAPFUND117) is an actively managed fund and is our top fund basis the 5 year CAGR, as on 30th June, 2025. *Fund performance and Morningstar Rating data as of 30th June 2025. Within each Morningstar Category, the top 10% of funds receive five stars, the next 22.5% four stars, the middle 35% three stars, the next 22.5% two stars, and the bottom 10% are rated one star. ‘Morningstar, Inc. is a leading provider of independent investment insights in North America, Europe, Australia, and Asia. For detailed information related to Morningstar and it's trademark visit our website www.pnbmetlife.com. #The above illustration shows value of Rs. 5 Lakh invested on 1st July 2020 in PNB MetLife Mid Cap Fund, accumulated as of 30th June 2025 (a five year period). This illustration is calculated basis pure investment returns generated by the fund and not accounted for various charges that are deducted in the form of units in the ULIP bought. Past performance is not indicative of future performance. Please refer to the customized product illustration where in returns are shown at assumed investment rates of 4% and 8% respectively. Assumed rates of interest are not the upper or lower limits. For more details on risk factors, terms & conditions, please read the sales brochure carefully before concluding a sale. This fund is suitable for individual with high risk tolerance and long-term investment goals. Unit-linked life insurance products are different from the traditional insurance products and are subject to risk factors. Premiums paid in unit-linked life insurance policies are subject to investment risks associated with capital markets, and NAV of the units may go up or down, based on the performance of the fund and factors influencing the capital market and the insured is responsible for his/her decisions. Please know the associated risks and the applicable charges from your insurance agent or intermediary or policy document issued by us. PNB MetLife Insurance Company Limited is the name of the Life Insurance Company and the Unit Linked Insurance Plan Names – PNB MetLife Goal Ensuring Multiplier (UIN: 117L133V07), PNB MetLife Mera Wealth Plan (UIN: 117L098V08), and PNB MetLife Smart Platinum Plus (UIN: 117L125V06) and PNB MetLife TULIP (UIN: 117L136V04) are only the names of the unit-linked life insurance contracts and do not in any way indicate the quality of the contract, their future prospects or returns. The various funds offered under these contracts are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns. PNB MetLife India Insurance Company Limited. Registered office address: Unit No. 701, 702 & 703, 7th Floor, West Wing, Raheja Towers, 26/27 M G Road, Bangalore -560001, Karnataka. IRDAI Registration number 117 | CIN U66010KA2001PLC028883. The marks "PNB" and "MetLife" are registered trademarks of Punjab National Bank and Metropolitan Life Insurance Company, respectively. PNB MetLife India Insurance Company Limited is a licensed user of these marks. Call us Toll-free at 1-800-425-6969, Website: www.pnbmetlife.com, Email: indiaservice@pnbmetlife.co.in or Write to us: 1st Floor, Techniplex -1, Techniplex Complex, Off Veer Savarkar Flyover, Goregaon (West), Mumbai – 400062, Maharashtra. AD-F/2025-26/441

The past performance of the funds is not indicative of the future performance. Assumed rate of returns are not guaranteed and these are not the upper or lower limits. Unit Linked Life Insurance products are different from the traditional insurance products and are subject to the risk factors. The premium paid in Unit Linked Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/her decisions. PNB MetLife India Insurance Company Limited is only the name of the Life Insurance Company and PNB MetLife Smart Goal Ensuring Multiplier is only the name of the unit linked insurance contract and does not in any way indicate the quality of the contract, its future prospects or returns. Please know the associated risks and the applicable charges, from your Insurance agent or the Intermediary or policy document issued by the insurance company. The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns. The policyholder can know the value of policy wise units as per the FORM D02 through a secured login on the PNB MetLife website (www.pnbmetlife.com)

These are returns of benchmark indices and are not indicative of the return of PNB MetLife Value Fund.

PNB MetLife Smart Goal Ensuring Multiplier (An Individual, Unit-Linked, Non-Participating, Life Insurance Plan UIN:117L139V01).T&C apply.

*The return shown is the 5-year annualized return of the NIFTY 500 Value 50 Index as on 30th May 2025. PNB MetLife Value Fund (SFIN: ULIF03615/07/25VALUEFUNDS117) is an actively managed fund with the NIFTY 500 Value 50 Index as its benchmark.

#NAV of Rs. 10/- will be applicable for duly completed proposals received from 15th to 27th July 2025, and issued on 28th July 2025. For policies issued after 28th July, the prevailing NAV on the day of issuance will be applicable.

This fund is suitable for individuals with high risk or low risk as the case may be. Past performance is not indicative of future performance.

Please refer to the customized product benefit illustration where in returns are shown at assumed investment rate at 4% and 8% respectively. Assumed rate of returns are not guaranteed and these are not the upper or lower limits.

For more details on risk factors, terms & conditions, please read the sales brochure carefully before concluding a sale. PNB MetLife India Insurance Co. Ltd. IRDAI Reg. No. 117. AD-F/2025-26/323.

The marks "PNB" and "MetLife" are registered trademarks of Punjab National Bank and Metropolitan Life Insurance Company, respectively. PNB MetLife India Insurance Company Limited is a licensed user of these marks.

Email: indiaservice@pnbmetlife.co.in or Write to us: 1st Floor, Techniplex -1, Techniplex Complex, Off Veer Savarkar Flyover, Goregaon (West), Mumbai – 400062, Maharashtra. Phone: +91-22-41790000, Fax: +91-22-41790203.

| Beware of Spurious Phone Calls and Fictitious / Fraudulent Offers! IRDAI or its officials is not involved in activities like selling insurance policies, announcing bonus or investments of premium. Public receiving such phone calls are requested to lodge a police complaint. |

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

As your trusted life insurance partner, PNB MetLife covers COVID-19 claims. In the event of a death claim, please submit a signed claim form mentioning the policy number, a brief description of the insured event, and all other mandatory claim documents to the email addresses provided below. You may write to us at claimshelpdesk@pnbmetlife.com or indiaservice@pnbmetlife.co.in. For death claim intimation or any queries, you can also call us at 1800-425-6969 (for customers calling from within India only), Monday to Saturday, between 10:00 am and 7:00 pm.

PNB MetLife Insurance, amongst the trusted Life Insurance companies in India, aims to provide a wide range of Life Insurance products that suits the needs of an individual at every stage of his life. Life Insurance Plans range from Term Life Insurance Plans, Term Plan, Protection Plans, Long Term Savings Plans , Retirement Plans & Child Education Plan.

Get Trusted Advice

Get Trusted Advice