We've got you covered through the Circle of Life. Explore the variety of life insurance plans and solutions at PNB MetLife.

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

What more can life insurance offer you?

Investment Opportunity

A unit-linked plan can offer you a great investment opportunity along with securing your family’s future. Like all market-linked plans, ULIPs are subject to market fluctuations, but they are perfect for those with a higher risk appetite.

Loan Facility

Depending on the type of life insurance policy taken, your plan can give you the opportunity to secure a loan against it at more competitive rates than other modes.

Tax Benefits

Your life insurance policy can get you tax benefits from the moment you start paying premiums! Availing this benefit can help you save up to Rs. 1,50,000 from your taxes. However, you can claim this benefit only when the premiums paid don’t exceed 10% of the sum assured (under sec 80 C, I-T Act, 1961).

Fresh in the workforce & don’t have a clue about life insurance.

Marriage, loans, kids - sounds like you need a life insurance upgrade.

Well settled in many areas. But there are always ups & downs in life.

Your kids are all grown up. See them prosper!

In your 20s with fewer cares in the world? This is the ideal time for you to begin planting the seeds of a fruitful investment. Since time is on your side, you can also begin with an amount that you are comfortable with and gradually increase only when income & responsibilities do.

This is what your plan would look like:

You are fast approaching your mid-30s and it has been a while since you’ve evaluated your life insurance needs. This is a good time to do a health check on your life insurance policy and consider an upgrade

This is what your plan would look like:

Life is going as planned in your mid-40s but there is always room for added protection. Making changes to your life insurance plan at this stage in life is a sign of you constantly staying in touch with your family’s needs. We have just the plans that could help increase protection.

This is what your plan would look like:

In your 50s, you’re getting ready to leave the workforce. And just in time, too, as your kids are now branching out to make their mark on the world. Now is a great time to adjust your life insurance plan and enhance the nest egg you’ve created for your loved ones!

This is what your plan would look like:

A Legacy Of Trust

We have settled 97.18%* of claims received for retail business and 99.33%* for the group business for FY 2019-20 *Please visit IRDAI website www.irdai.gov.in for further details.

Unmatched Expertise

Over the past two decades, we have been creating expert insurance solutions for many happy families

Complete Transparency

No more hidden clauses, obscure terms and industry jargon. We believe that protecting your life should be hassle-free and uncomplicated.

End-To-End Guidance

From evaluating your needs to selecting the right plan to paying premiums, we are here with you every step of the way, should you need any help.

Insight-Led Offerings

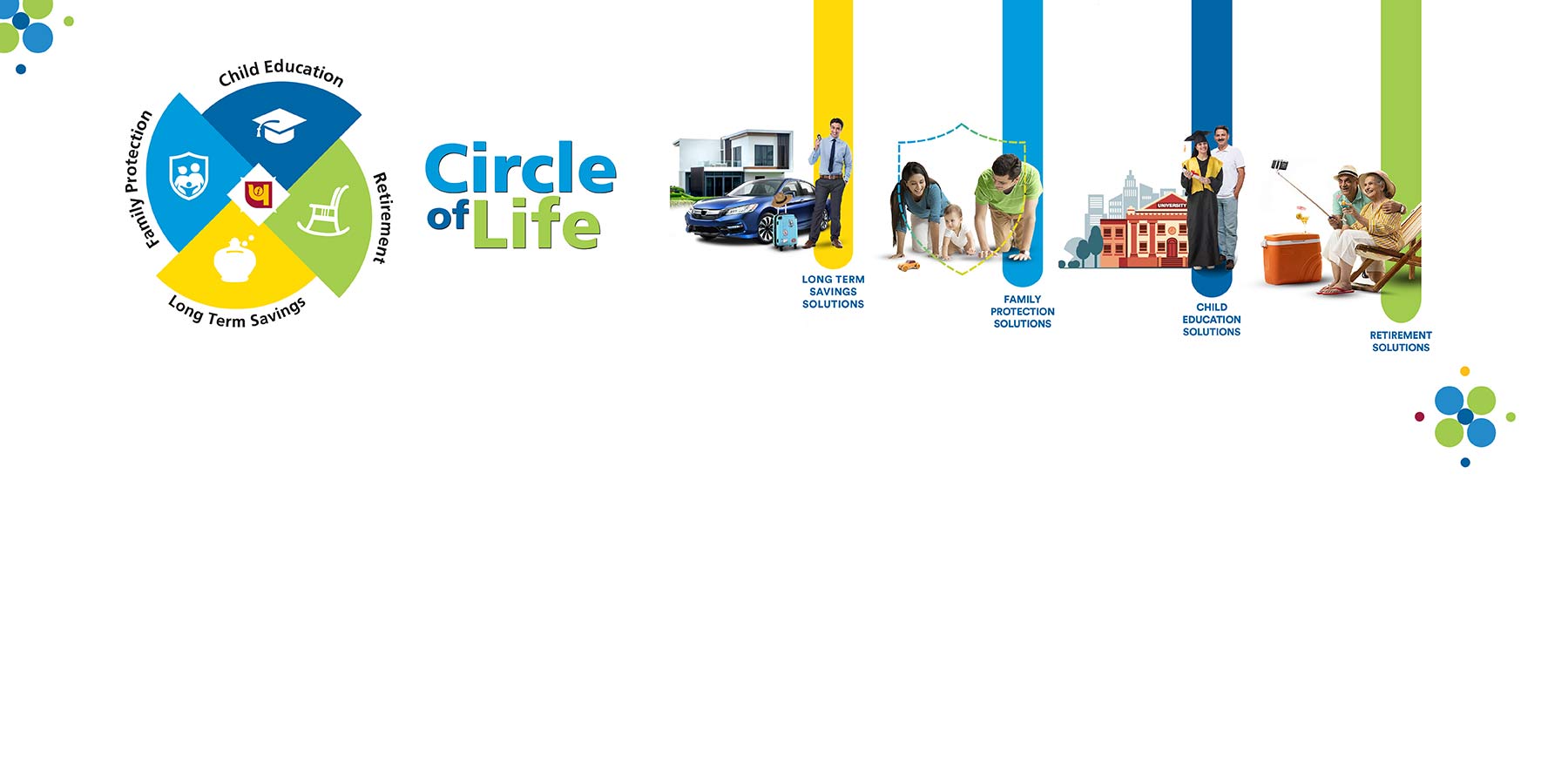

We have developed plans for every stage and every need of your life, be it Family Protection, Child Education, Long Term Savings or Retirement and more!

Life is all about taking care of little nuances. From saving for your dream home to ensuring a safe future for your family, from planning your kid’s education to investing enough for your retirement days, PNB MetLife Plans for all your dreams and offers perfect solutions for evert life’s necessity.

The death of a loved one can be an emotionally turbulent event. Grieving could take anywhere between days to months and years. The stress magnifies if the person happens to be the family’s breadwinner. The financial stress that comes with the emotional crisis under such circumstances can be crippling. The loss of a life in this case also means the loss of a steady income, putting pressure on the reserves of savings along with dealing with the reality of how to maintain your lifestyle without any inflows in the immediate future.

Life insurance is an agreement of protection, and sometimes even wealth creation, between the insurance company and the customer. Under this agreement, the insurer guarantees to pay the beneficiary or nominee of the assured life a pre-decided amount of money in the unfortunate event of the assured/policyholder’s demise during the term of the life insurance plan.

In return for this promise, the policyholder pays a predefined sum of money called premium on a regular basis, the frequency and duration of which can be chosen by the policyholder. The policyholder is also free to decide the quantum of sum assured under the policy. This will be the sum paid out to his or her beneficiaries and it also determines the amount of premium that will be required to be paid. In addition to that, as the policyholder, you can also get additional riders to your policy, such as the Critical Illness Rider or the terminal illness rider, which will protect you from specific contingencies. Apart from the death benefits, some types of life insurance plans also provide maturity benefits. These benefits are payouts provided to the assured if he or she survives the entire term of the life insurance policy.

Here are the benefits that make a life insurance policy a lucrative financial product

Death Benefits

The immediate benefit of a life insurance plan, by the very nature of this product, is that it provides financial support to the insured or the insured’s dependents in times of mishaps or in the unfortunate eventuality of death. This sum is often referred to as the death benefit. Thus, it brings the foremost benefit of any life insurance plan: that of providing financial security in times of untimely eventualities like the death of the bread earner of the family. Essentially, a life insurance plan helps you provide for your family and dependents even in your absence.

Investment Benefits

The perks and benefits of a life insurance policy go beyond basic financial protection, however. It can also act as an effective investment avenue. Life insurance plans can also function as an investment opportunity with significant returns on investment. Such hybrid products like unit-linked insurance plans helps you to select the market funds in accordance with your risk appetite. Fosters savings and wealth creation Being a long-term commitment, life insurance helps to inculcate the habit of savings. Saving money over a long time period helps to build a corpus that can be crucial in meeting financial needs at different junctures in life.

Fosters savings and wealth creation

Being a long-term commitment, life insurance helps to inculcate the habit of savings. Saving money over a long time period helps to build a corpus that can be crucial in meeting financial needs at different junctures in life.

Loan Facility

You can also avail a loan against your life insurance policy. In fact, life insurance policies can be used to secure a loan at a significantly more competitive rate as compared to other modes. The amount of loan that can be sanctioned will depend upon the type of life insurance plan and the surrender value of the same

Tax Benefits

Life insurance tax benefits begin right when you start paying the premiums. Under section 80C of the Income Tax Act, 1961, the policyholder can avail tax benefit on the premium paid towards life insurance plans. The premium paid towards life insurance plans is eligible for deduction under this section up to the maximum limit of Rs. 1,50,000. Simply put, you can reduce up to Rs. 1,50,000 from your total taxable income while filing your Income Tax Return. These tax benefits extend to all life insurance plans, including those with an investment component, like ULIPs. However, to claim a deduction under section 80C the premium paid should not exceed 10% of the sum assured where the policy has been issued after 1st April 2012. For policies issued prior to 1 April 2012, the premium paid should not exceed 20% of the sum assured. Under Section 10(10D) of the Income Tax Act, 1961 the sum assured amount including the sum allocated by way of bonus on such a policy paid on surrender or maturity of the policy or in case of death of the insured in entirely tax-free for the receiver.

The policyholder is the individual who purchases a life insurance plan. The nominee or beneficiary as listed in the policy is the individual who receives the insurance plan benefit amount which is referred to as the sum assured, after the death of the life insured. The nominee is usually a family member or a dependent.

Life insurance is a long-term financial step in saving and creation of your wealth. It can help safeguard the future in financial terms. Thus, it fundamentally provides both saving as well as protection.

Depending on the life stage you are at, the kind of financial goals you plan to serve, and the risk appetite you carry, you can choose a life insurance product that aligns with your requirements. It can be a term insurance product if you want a pure protection product or a hybrid product like ULIPs or moneyback plans if you seek steady returns for funding your kid’s education or a pension plan that can bring you steady income post-retirement. Find out more about life insurance riders to add on more insurance coverage.

As mentioned before, life insurance plans feature high on the list of tax-saving mechanisms. The premiums that you pay for your life insurance plan is eligible for a tax deduction of up to Rs. 1.5 lakh under Section 80C, 80CC, 80CCE of the Income Tax Act, 1961. As per Section 10 (10D) of the Income Tax Act, 1961, the maturity and death benefits are also exempt from taxation.

Life insurance premium is heavily determined by the age of the policyholder, which is why it is advised to get life insurance policy early in life. If the potential policyholder is young, the premium rates of the policy will be low as compared to the premium rates for an older individual. This is because young people are considered less prone to life-threatening diseases and the possibility of death.

In order to understand how life insurance plans, work, you need to look at two critical points. One is the purchase of the policy, and another is when the claim settlement must take place.

Let’s look at them one by one.

Purchase of policy, premium and lump sum payments:

Under the life insurance agreement, the insurer promises financial protection by paying out death benefits in a lump sum or as regular payouts to nominees/beneficiaries in the unfortunate event of the demise of the life assured. These beneficiaries are designated in the policy documents itself and are usually family members or dependents of the life assured. The sum assured can be decided by the policyholder and should be enough to help your family maintain their lifestyle in your absence. Hence, a multiplier with your monthly salary is a good way of arriving at this figure. In return for this promise, the policyholder is supposed to pay an amount called premium. The amount of premium to be paid is defined at the time of purchase of the policy. To calculate the premium under a life insurance policy, the insurer takes your lifestyle and finances into consideration.

Claim settlement process with the insurer:

Upon the happening of the event for which the policy is drawn, the insurer will pay the beneficiary the entire coverage amount. Instead of a lump sum, if you want you can be paid in the form of instalments to the beneficiary/beneficiaries after your sudden death. The insurance company may also pay bonuses, based on the amount that has been accumulated over the policy tenure.

In order to acquire this money, the beneficiary/relative of the deceased policyholder has to get in touch with the insurer to intimate them of the situation. You have to provide the policyholder’s death certificate as a proof, along with other necessary documents as required by the company. After reviewing the documents, the insurer will either accept or reject the claim. Following that, an arrangement would be worked out for the payment of regular payouts or the lump sum.

Life insurance plans are heavily customized to suit your individual needs. There’s no one size fits all. However, life insurance is broadly classified into these categories, the parameters being the presence/absence of an investment or money back component, the goal they aim to serve, and scope of coverage.

| Type of life insurance | Description of the product |

|---|---|

Term Insurance |

Term insurance is a pure insurance product, which is to say it covers the risk of dying. Under term insurance, the pre-decided sum assured is paid out to the beneficiary or nominee in case of the sudden demise of the insured during the tenure of his or her policy. This sum, called death benefit, is paid out either as a lump sum or as a monthly or annual pay-out, or as combined benefits to the nominee. |

Child Plan |

A child plan is a type of ULIP that helps to create a corpus with the specific aim or objective of supporting your child's higher education. In the event of your untimely demise, the death benefit will be paid to your child along with accrued bonuses. Further, all future outstanding premiums will be waived and money back payouts will be paid to the child as scheduled. A Child plan also provides flexible payout options to help you take care of the important milestones of your child's education. It basically combines insurance cover and investment to secure multiple stages of your child's life. |

Pension Plans |

Often also referred to as retirement solutions or annuity plans, pension plans are aimed at financially securing your post-retirement life. Such plans help to build a corpus for your retirement so that you can remain financially independent even after your working years are over. Therefore, pension plans are an investment instrument with an insurance component that caters to the needs of your post-retirement life. |

ULIP |

A unit-linked insurance plan (ULIP) is a type of life insurance plan that blends insurance & investment components. It presents a long-term investment opportunity along with life insurance coverage. Under a ULIP, the premium paid is partly used as a risk-cover for life insurance and part of it is invested in market funds ranging from debt, equity, hybrid funds, etc. You can select which market funds you wish to invest in, depending upon your risk penchant. |

Endowment Plans |

Endowment plans are traditional life insurance products that combined life insurance function with savings. In endowment plan a part of the amount goes in a life insurance cover and the rest goes towards investment. Some life insurance endowment policies may offer bonuses which are paid either to the policyholder at the time of policy maturity or to the nominee in case of a death claim. |

Money-Back Plans |

As is clear from the name, money back life insurance plans ensure a lump sum payment to the beneficiary of a policyholder in case his/her unexpected demise, along with survival benefits assigned proportionately throughout the policy tenure. In other words, a stipulated percentage of the assured sum, called the survival benefit, is paid back to the policyholder at pre-decided intervals. Thus, moneyback plans ensure high liquidity. |

Wealth Plans |

If you are seeking wealth creation avenues along with savings for a luxurious life, wealth plans bring that with an insurance component. |

Choosing the best life insurance plan can be intimidating due to the plethora of considerations, so here’s a quick checklist of parameters to make the right decision:

Time Period

If you want seek protection for a certain time period, then go for term insurance. If your medium or long-term goal is to provide for your child’s education, choose an insurance plan that lasts around a decade. If you seek a lifelong insurance plan, then a whole life plan is the right choice. Simply put, align the tenure of the policy with your larger financial goal.

Type of life insurance plans

If you are only seeking protection for your family, choose term insurance. If you are looking for policies than can pay off debts, check out ULIPS, pension plans, money back plans, endowment plans etc., based on the time-period and individual needs.

Premium

Premium is an important factor, especially if you consider life insurance as a tax-saving product. The premium amount for endowment plans, ULIPs etc. are on a higher side when compared to term insurance, Money Back Plans and Pension Plans.

Arrive at a reasonable Sum assured

How many dependents do you have? Are you the sole breadwinner? One basic rule of thumb is that the death benefit on your policy should equal 7 to 10 times the amount of your annual salary.

Research, Compare and decide

Go online, seek quotations for your requirements by filling the appropriate forms and then compare them in terms of the policy period, premium, coverage. it is so much more convenient to buy life insurance online. To get an estimate how much premium you need to pay, you can refer to online life insurance premium calculator to get an overall idea about the premium calculations.

Buying online life insurance policy is a convenient, cost-effective and a pretty straight-forward process.

Furnish Basic Details

To begin with, you need to furnish your basic details in an application form, such as name, date of birth, contact details, smoking and lifestyle habits, income, expected life cover. This will generate quotes and provide different options to choose from.

Premium Payment

Once you have decided on the insurance policy you intend to go ahead with, the next step is the payment of the premium. You can pay using the modes of payment listed on the insurer's portal.

Provide Required Documents

The list of required documents will be sent to you once you fill the form and pay the premium, including identity proof, address proof, or health certificates.

Pre-policy Health Test

Some insurers require the potential policyholder to undergo a medical test. Such reports also need to be furnished.

Issue of Policy

Once all the documents are in place, the insurer will confirm your application and draft your policy papers.

At PNB MetLife, we understand that life is about the little moments and memories. In keeping with that belief, our life insurance helps you live worry-free amid the uncertainties of life.

We make sure your loved ones feel safe and financially protected from all harm in the unfortunate event of your demise and extend long-term financial security.

We bring together the financial strength of a leading global life insurance provider, MetLife, Inc., and the credibility and reliability of PNB, one of India's oldest and leading nationalized banks

We have a vast distribution reach with presence in over 111 locations across the country, serving over 100 million customers.

You can buy life insurance anytime between 18 to 90 years of age, but the sooner you get it, the better. Getting life insurance at a younger age ensures lower premium rates.

The amount of life insurance depends on various parameters like your age, number of dependents in your family, your debts and liabilities, your standard of living etc. As a rule of thumb, it is recommended that you choose a cover that is at least 10 to 15 times your current annual income.

A claim settlement ratio is the percentage of the number of insurance claims settled against the number of claims filed in a financial year. You should opt for an insurer with a high claim settlement ratio.

Even if you are a regular smoker, you can be eligible for a life insurance policy. However, you will have to pay a higher premium than a non-smoker.

Life insurance is a legal contract that binds the insured policyholder and the insurance service provider. You, the insured, are required to pay premiums to the insurance company in return for which the insurer promises a protective financial cover. The financial cover can be in the form of an assured sum that’s paid out to your beneficiaries/nominees in the event of your demise. Alternatively, if you survive the tenure of the policy, some life insurance plans also give you a maturity benefit.

The unequivocal answer is yes. Life insurance is an extremely essential part of financial planning, particularly if you’re the breadwinner of your family and if you have financial dependents. In the event of your death, the financial benefits of a life insurance policy can help the surviving members of your family cope with the sudden loss of the main source of income. Additionally, it also equips them to pay off any debts or liabilities you may have left behind. The monetary cushion offered by a life insurance policy can help your family and beneficiaries significantly.

The purpose of life insurance is to help your family or your financial dependents survive the loss of revenue, at least until they can find an alternative source of income. So, the estimates will typically vary depending on your family’s average levels of spending. One way to approach this is to follow the general rule of thumb and opt for life insurance that is at least 7 to 10 times your annual income. Alternatively, you can also calculate the amount of income required for your family to survive after your demise. Subtract any other sources of income from that amount, and the balance is the insurance cover you need.

The cost of life insurance is directly proportional to the death benefits and maturity benefits offered by the plan. Other factors such as your age at the time of application and your medical history also play a significant role in determining the cost. The premium charged also varies from one policy to another. Depending on these factors, you can purchase a life insurance policy for as low as around Rs. 2,000 per month or for as high as Rs. 10,000.

You have the option to choose the scheme of paying your premiums. Depending on what’s convenient for you, you can opt to pay a single premium and purchase the cover, or you could choose to pay monthly, quarterly, semi-annual, or annual premiums. In addition to this, you also have the freedom to choose the mode of making these payments. If you prefer offline transactions, you can pay your premium using bank challans, demand drafts, or checks. Alternatively, you can also make the payments online using direct bank transfers or head to the insurer’s web portal to pay the premium.

If you do not pay your premium on time, you run the risk of your policy lapsing. Most insurers generally offer you a grace period within which you can catch up on the payments you’ve missed. However, once the grace period is up, your life insurance policy lapses. This means that you will no longer be eligible to enjoy the protective cover of death benefits or maturity benefits. If you find yourself in this situation, you can reinstate your policy by contacting your insurer and paying all the outstanding premiums along with the interest and penalties charged on them, if any.

The primary benefit of a life insurance policy is protective financial cover it offers. In case the policyholder dies, the beneficiaries or the nominees receive a lump sum payout to help them through tough times. Additionally, with a life insurance policy, you can also enjoy tax benefits on the premiums paid to purchase the policy. If you survive the tenure of the policy, you may even receive maturity benefits, depending on the kind of plan you opted for. Life insurance policies also allow you to take a loan against the plan in case you need to borrow funds to meet your life goals.

In addition to offering you a life cover, these insurance policies also provide tax benefits. According to section 80C of the Income Tax Act, the premiums you pay in each financial year can be claimed as a deduction from your total taxable income for that year. This has the effect of reducing your income, and therefore, also brings down the taxes you are liable to pay. The maximum amount of deduction you can claim is Rs. 1.5 lakhs each year.

If your insurance policy “matures,” it essentially means that cash value of the policy has grown to equal the death benefits. If you survive the term of the policy and live to see it reach maturity, the insurance provider generally pays out a lump sum amount, known as the maturity benefit. It includes the value of all the premiums you paid during the policy’s tenure, over and above which a bonus is added. In some cases, the insurer may extend the maturity date and make the lump sum payment only on the policyholder’s demise.

Most people generally purchase insurance policies from insurance representatives employed by the insurer. These third-party agents help people understand the features and benefits of various policies offered by the insurance company. On the other hand, if you prefer dealing directly with the insurer, you can simply visit a branch office, submit the necessary documentation, and purchase the policy of your choice. In recent years, with increased digitization, it’s also possible to buy life insurance online. If you’re tech-savvy and prefer online transactions, you can always head to the insurer’s web portal and purchase the policy of your choice from their site.

If the policyholder passes away, the nominee or legal heirs need to claim the death benefits offered by the policy. To file a life insurance claim, the first thing you’ll need is multiple copies of the death certificate. If you’d purchased the policy through a representative, you can then reach out to your agent, who will help you fill out the necessary forms and submit the claim on your behalf. Another way to do this is to directly visit the branch office, fill out the forms yourself, and submit the claim to the insurer. Some companies also offer the option of filing a claim online.

If you’re the primary breadwinner in your family, it’s evident that they depend on you for their financial requirements. In the event of your unfortunate demise, your dependents will need a monetary safety net to fall back on. A life insurance plan can help your spouse, kids, parents, or other financially dependent relatives meet their essential expenses in the immediate aftermath of your demise. Additionally, it can also help them repay any debt you may have left behind or pay for important needs like healthcare and education.

A life insurance policy can be beneficial to the policyholder in more ways than one. Here are the main advantages of investing in this instrument.

The term of life insurance policies varies from one provider to another. Typically, most insurers offer different plans with varying tenures. You can invest in life insurance that lasts for 10, 20, or even 30 years, depending on your age when you purchase the policy. Ideally, the younger you are when you invest in life insurance, the longer your policy can be. Shorter policies may mean higher premium payments. Some insurers providers also offer the option of 5-year or 10-year increments on the original policy term.

Most life insurance policies generally offer death benefits in case of natural deaths, such as those caused by a heart attack or old age. Life insurance also almost covers the deaths caused by accidents. In addition to death benefits, you can also opt for enhancer coverage with additional covers like a critical illness rider or a disability rider, which can help your family cope with financial distress in case the policyholder is diagnosed with a critical illness like cancer, or in case they’re unable to continue earning on account of any disability. In such situations, the rider on your policy may either offer a lump sum payment or ensure that you receive a steady sum of money periodically.

Yes, they are. As per the provisions of section 80C, the premiums you pay for your life insurance are deductible from your total taxable income. The maximum amount of deductions you can claim is Rs. 1.5 lakhs per financial year. If your premium payments add up to less than Rs. 1.5 lakhs, then the entire amount of premiums paid are deductible.

The earlier you invest in a life insurance plan, the more affordable it gets. When you’re younger, you have years of earning income ahead of you. You’re also healthier and generally more fit. So, insurance providers will charge you a more affordable premium in this case. Another way to make premiums fit better into your budget is to buy only the amount of coverage you actually need. You could also opt for a term plan that offers a pure protective cover, since these plans typically charge premiums that are relatively lower.

Here’s a quick look at the most commonly used life insurance terms.

Premium:Premium refers to the periodical payments made by the policyholder to the insurance company in exchange for purchasing the policy. Premiums can be one-time payments, limited-term payments, or regular outlays made over the entire tenure of the policy.

Sum assured:This is the amount that the insurance service provider will pay to the nominee in the event of the policyholder’s death.

Maturity benefit: This term refers to the sum that the insurer pays the policyholder if the latter survives the policy tenure. Term insurance plans do not offer any maturity benefits, but life insurance plans do.

Surrender value: In case the policyholder decides to discontinue premium payments before the policy matures, there’s always the option of surrendering the policy back to the insurer. On doing this, the insurance company pays the policyholder the surrender value, which is typically a certain percentage of the total basic premiums paid till surrender.

If you opt for a single premium policy, it means you’ll only need to make one payment. So, in this case, you can opt for the longest term offered by the insurer. On the other hand, if you opt to pay premiums periodically, ensure that you spread the payment period across your working years. By doing this, you can rest assured that you have the earning capacity to make all your premium payments on time. Keep in mind that policies that spread over a shorter period may often mean higher premiums.

You can change the nominee in your insurance plan either online or offline. In either case, you need to fill out the relevant nomination form and submit it to the insurance company. Depending on the particulars submitted, your insurance provider will update the nominee’s details in your insurance plan.

To purchase a life insurance policy online, you’ll need to submit various KYC documents to verify your age and address. Among these documents are your PAN Card, Aadhaar Card, Passport, Voter ID, Ration Card, Birth Certificate, Driving License, and Marriage Certificate if you’re married.

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

As your trusted life insurance partner, PNB MetLife covers COVID-19 claims. In the event of a death claim, please submit a signed claim form mentioning the policy number, a brief description of the insured event, and all other mandatory claim documents to the email addresses provided below. You may write to us at claimshelpdesk@pnbmetlife.com or indiaservice@pnbmetlife.co.in. For death claim intimation or any queries, you can also call us at 1800-425-6969 (for customers calling from within India only), Monday to Saturday, between 10:00 am and 7:00 pm

PNB MetLife Insurance, amongst the trusted Life Insurance companies in India, aims to provide a wide range of Life Insurance products that suits the needs of an individual at every stage of his life. Life Insurance Plans range from Term Life Insurance Plans, Term Plan, Protection Solutions, Long Term Savings Solutions , Retirement Solutions & Child Education Solutions.

Get Trusted Advice

Get Trusted Advice