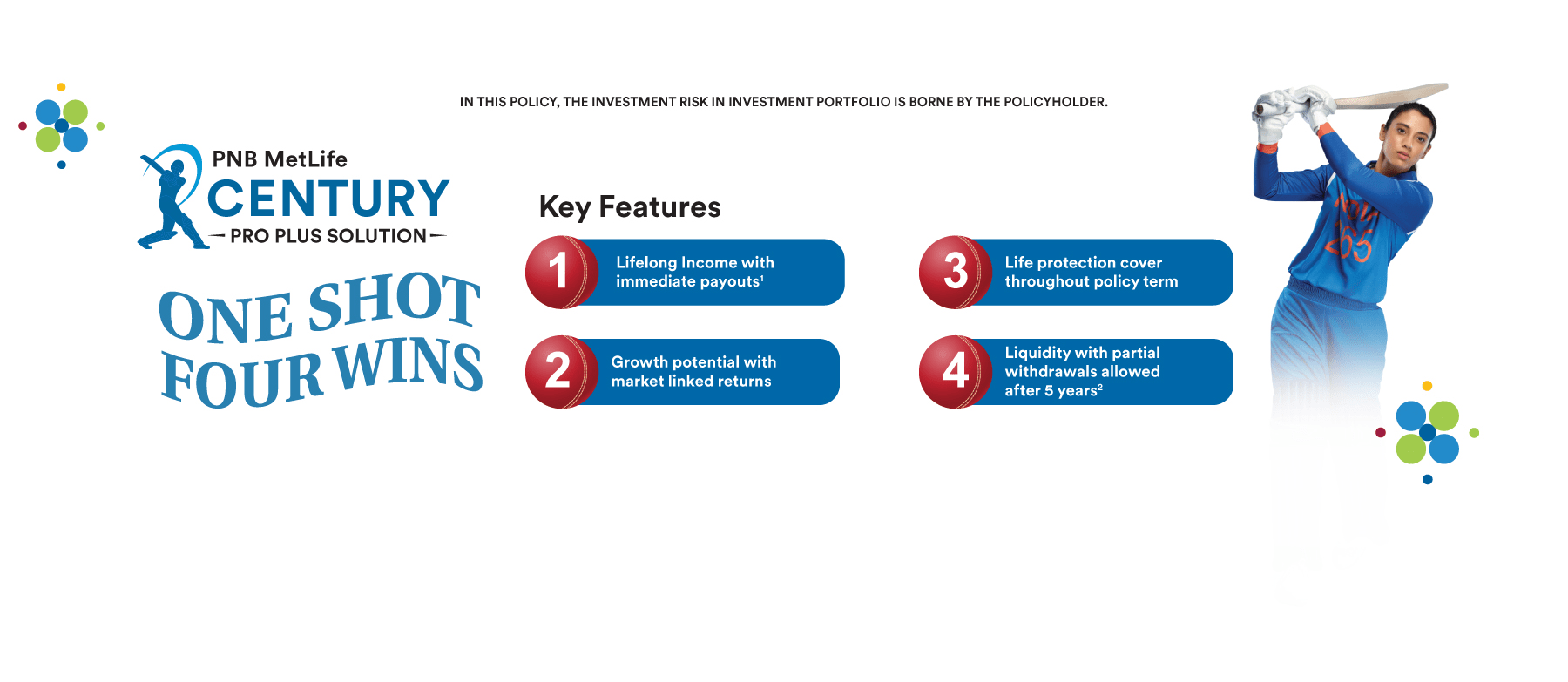

PNB MetLife Century Pro Plus Solution

Create a legacy for your loved ones and maximize your wealth with the combined power of PNB MetLife Century Plan and PNB MetLife Smart Platinum Plus

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

Disclaimer:

Linked insurance products are different from the traditional insurance products and are subject to the risk factors.

The premium paid in linked insurance policies are subject to investment risks associated with capital markets and publicly available index. The NAVs of the units may go up or down based on the performance of fund and factors influencing the publicly available index and the insured is responsible for his/her decisions.PNB MetLife India Insurance Company Limited is only the name of the Life Insurance Company and PNB MetLife Smart Platinum Plus is only the name of the linked insurance contract and does not in any way indicate the quality of the contract, its future prospects or returns.

Please know the associated risks and the applicable charges, from your insurance agent or intermediary or policy document issued by the insurance company.

The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns. The past performance of the funds is not indicative of the future performance.

IN THIS POLICY, THE INVESTMENT RISK IN INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDER.

The unit linked insurance products do not offer any liquidity during the 1st five years of the contract. The policyholder will not be able to surrender/ withdraw the monies invested in unit linked insurance products completely or partially till the end of the fifth year.

The risk factors of the bonuses projected under the product are not guaranteed and past performance doesn't construe any indication of future bonuses.

These products are subject to the overall performance of the insurer in terms of investments, management of expenses, mortality and lapses.

This advertisement is designed for combination of Benefits of two individual and separate products named (1) PNB MetLife Smart Platinum Plus (Individual, Unit Linked, Non-Participating, Life Insurance Plan) - UIN:117L125V06 and (2) PNB MetLife Century Plan (Individual, Non-Linked, Participating, Savings Life Insurance Plan) - UIN:117N129V02. These products are also available for sale individually without the combination offered/ suggested. This benefit illustration is the arithmetic combination and chronological listing of combined benefits of individual products. The customer is advised to refer the detailed sales brochure of respective individual products mentioned herein before concluding sale.

For more details on risk factors, terms and conditions, please read the individual sales brochure before concluding any sale.

1Maximum maturity age up to 99 or 100 years as per maturity age option chosen by the policyholder.

AD-F/2025-26/312

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

As your trusted life insurance partner, PNB MetLife is with you amidst the current COVID-19 outbreak. Our policies also cover COVID-19 Claims. In case of a Death Claim, kindly submit the signed Claim Intimation Letter mentioning the policy number, brief of the insured event and other claim documents on the email mentioned herewith. Please write-in to us at claimshelpdesk@pnbmetlife.com or indiaservice@pnbmetlife.co.in. You can also call us on 1800-425-6969 for death claims intimations and for any queries on Monday - Saturday between 10:00 am - 7:00 pm.

PNB MetLife Insurance, amongst the trusted Life Insurance companies in India, aims to provide a wide range of Life Insurance products that suits the needs of an individual at every stage of his life. Life Insurance Plans range from Term Life Insurance Plans, Term Plan, Protection Plans, Long Term Savings Plans , Retirement Plans & Child Education Plan.

Get Trusted Advice

Get Trusted Advice