Investing is one of the best ways to grow your money in 2025. However, there are a lot of different types of investing. Have you ever thought about how some investors always seem to invest in the stocks that are underpriced today, but always increase in value in the future? This type of investing is called value investing. It is a type of investing where you invest in stocks that are undervalued and discounted today but have huge growth potential and can give you a lot of return on your investment.

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

Whether you are an investor who is starting out or someone who wants to diversify their investments, understanding how value funds operate can help you in making better investment decisions. This blog will discuss everything you need to know about what a value fund is, what the benefits of investing in it are, and how to choose the best value fund.

A value fund is an investment fund or mutual fund that works on the principle of value investing. In this type of investing, you purchase the shares that are undervalued in the market today but have very solid fundamentals and can grow a lot in the future. Most shares of value funds are less than their actual value due to short-term setbacks or investor ignorance. These funds are ideal for investors who want long-term investment plans.

Value investing funds are becoming more and more popular in India, particularly among people who want long-term growth but don't want to take huge risks. Value funds generally invest in established companies that are priced at a discount compared to their true worth.

Value funds are handled by skilled fund managers who make use of careful research and analysis to spot undervalued stocks. They consider different factors such as:

Once the stocks are identified, the fund manager buys them for the long term. The hope is that eventually, the market will see the true value of such stocks and the price will increase to give returns to the investor.

Investing in value funds is one of the most underrated types of investing in India. Still, here are some of the main benefits of investing in value funds:

Over the last decade, value investing funds in India have seen a rise in numbers. Investors are increasingly becoming aware of fundamentals alongside the long-term returns rather than being trend-driven by the market.

Some of India's best value funds have always delivered reasonable returns by adhering to their very basic philosophy: buy low, hold, and wait for the market to recover.

This is a very common question, particularly for conservative investors. Stable value funds provide capital preservation and ongoing returns. Even though they are not very common in India's mutual fund industry, they are excellent low-volatility and periodic-income investment vehicles.

Value funds focus on fundamentals and stability and offer well-balanced returns with less susceptibility to risk. Hence, they are one of the best long-term investment plans for stable long-term growth.

Although value funds best suit long-term wealth generation, timing also plays a significant role. The following are certain situations where an investment in a value fund makes sense:

If you are not sure when to invest, then invest your value fund on the basis of your long-term investment plan to achieve your financial goal.

If you're an investor seeking investment as well as insurance, ULIP Plans (Unit Linked Insurance Plans) are one of the best options. They can help you invest in value-based funds on the equity side. This gives you the twin advantage of life cover and market-linked returns.

If you don't know the ULIP meaning, then you should understand it and see how it harnesses mutual funds and insurance in one comprehensive plan. It gives you the flexibility of a value fund along with the creation of long-term wealth.

Let’s simplify the difference:

| Feature | Value Fund | Growth Fund |

|---|---|---|

| Investment Strategy | Invests in undervalued stocks | Invests in high-growth potential stocks |

| Risk | Lower | Higher |

| Return Potential | Moderate but stable over long term | High but volatile |

| Suitable For | Conservative, long-term investors | Aggressive, short-to-medium-term investors |

If you're someone who prefers slow and steady over fast and risky, value funds might be your best bet.

Let's say that you invested ₹10,000 in a value fund that had undervalued shares of a car company. When you bought it, it was being sold at ₹100 due to some short-term regulatory issues.

However, the fund manager who helped you invest in that fund was positive that the company's fundamentals are solid and will give you great returns down the line. One year later, the market corrected, the company fixed its problems, and the stock price went up to ₹150. That's a return of 50%, simply by believing in the fundamentals and waiting.

This is the very essence of the philosophy of value investing: patience pays.

Picking the best value fund doesn't have to be confusing. Here are some expert tips to pick the one that can give you the most returns:

Value funds will be taxed the same as any other equity mutual fund:

If you're looking for a smart and stable way to build wealth over time, value funds are the way to go. They focus on buying high-quality companies at a discount and give their investments time to grow as the market corrects itself. Value investing doesn't rely on market fads to invest money; it is based on thorough research. If you are charting your financial future, saving for your child's education, or building towards a dream retirement, considering a value fund can give you peace of mind and stable returns.

Yes, many ULIP plans offer value-oriented equity fund options as part of their investment choices.

Value funds often hold up better during downturns because they invest in fundamentally strong companies available at lower valuations.

Ideally, you should stay invested for at least 5-7 years to see the full potential of value investing strategies.

Absolutely, investing through SIPs in value funds helps average out costs and builds wealth gradually over time.

Some value funds may offer dividend options, but regular payouts aren't guaranteed; it depends on the fund’s strategy and market conditions.

Related Articles:

What is Investment?

What is an Index Fund?

Index Funds in India 2025: Types, Benefits & How to Invest

Mid Cap Funds: Benefits, Risks, Taxation and How to Invest in 2025

Large Cap Funds: Profitable Investments for Long-Term Growth in 2025

What is NAV?

NPS vs. PPF: Which Is the Better Investment Option?

How to Double Your Money: A Detailed Investment Guide

THE UNIT-LINKED INSURANCE PRODUCTS DO NOT OFFER ANY LIQUIDITY DURING THE FIRST FIVE YEARS OF THE CONTRACT. THE POLICYHOLDER WILL NOT BE ABLE TO SURRENDER/WITHDRAW THE MONIES INVESTED IN UNIT-LINKED INSURANCE PRODUCTS COMPLETELY OR PARTIALLY TILL THE END OF THE FIFTH YEAR.

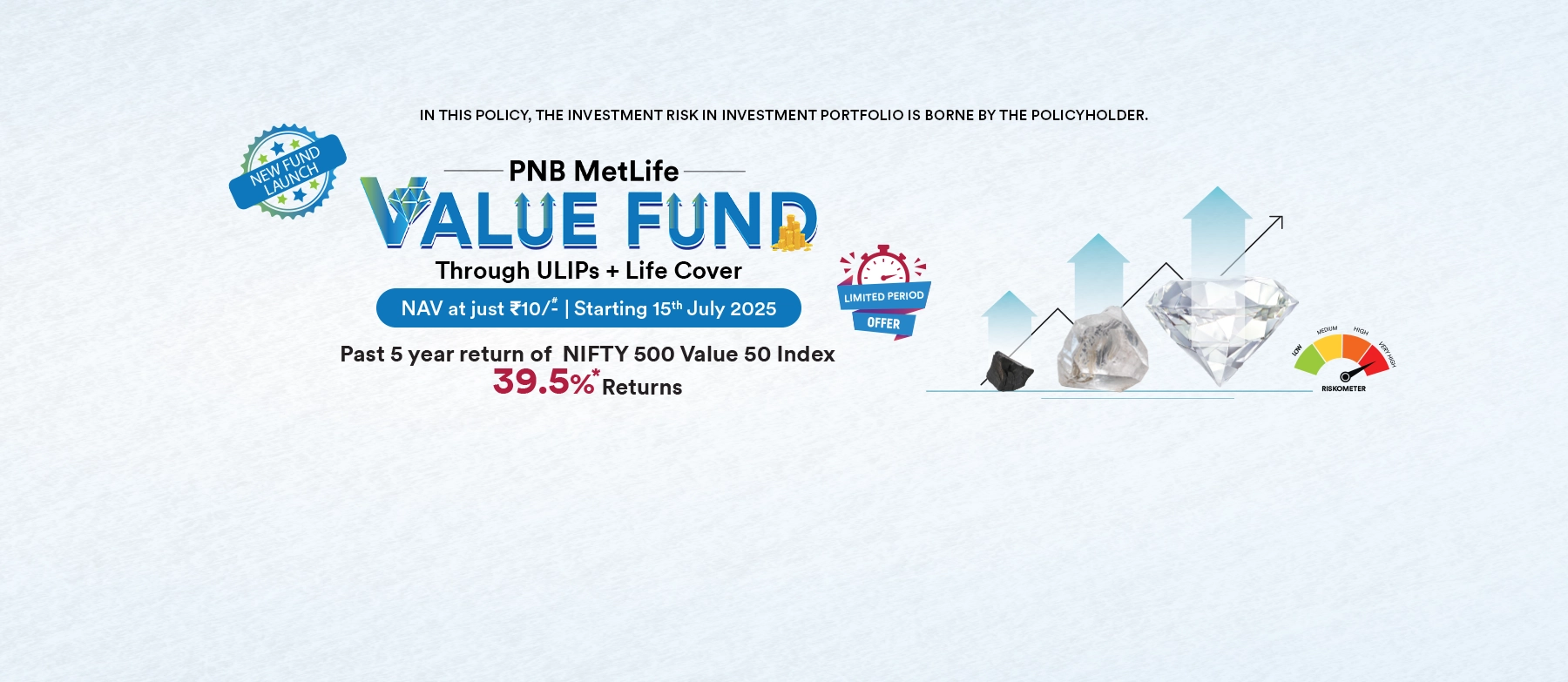

These are returns of benchmark indices and are not indicative of the return of PNB MetLife Value Fund.

PNB MetLife Smart Goal Ensuring Multiplier (An Individual, Unit-Linked, Non-Participating, Life Insurance Plan UIN:117L139V01).T&C apply.

*The return shown is the 5-year annualized return of the NIFTY 500 Value 50 Index as on 30th May 2025. PNB MetLife Value Fund (SFIN: ULIF03615/07/25VALUEFUNDS117) is an actively managed fund with the NIFTY 500 Value 50 Index as its benchmark.

#NAV of Rs. 10/- will be applicable for duly completed proposals received from 15th to 27th July 2025, and issued on 28th July 2025. For policies issued after 28th July, the prevailing NAV on the day of issuance will be applicable.

This fund is suitable for individuals with high risk or low risk as the case may be. Past performance is not indicative of future performance.

Please refer to the customized product benefit illustration where in returns are shown at assumed investment rate at 4% and 8% respectively. Assumed rate of returns are not guaranteed and these are not the upper or lower limits.

For more details on risk factors, terms & conditions, please read the sales brochure carefully before concluding a sale. PNB MetLife India Insurance Co. Ltd. IRDAI Reg. No. 117. AD-F/2025-26/323.

The aforesaid article presents the view of an independent writer who is an expert on financial and insurance matters. PNB MetLife India Insurance Co. Ltd. doesn’t influence or support views of the writer of the article in any way. The article is informative in nature and PNB MetLife and/ or the writer of the article shall not be responsible for any direct/ indirect loss or liability or medical complications incurred by the reader for taking any decisions based on the contents and information given in article. Please consult your financial advisor/ insurance advisor/ health advisor before making any decision.

The marks "PNB" and "MetLife" are registered trademarks of Punjab National Bank and Metropolitan Life Insurance Company, respectively. PNB MetLife India Insurance Company Limited is a licensed user of these marks.

Call us Toll-free at 1-800-425-6969, Phone: 080-66006969, Website: www.pnbmetlife.com, Email: indiaservice@pnbmetlife.co.in or Write to us: 1st Floor, Techniplex -1, Techniplex Complex, Off Veer Savarkar Flyover, Goregaon (West), Mumbai – 400062, Maharashtra. Phone: +91-22-41790000, Fax: +91-22-41790203.

| Beware of Spurious Phone Calls and Fictitious / Fraudulent Offers! IRDAI or its officials is not involved in activities like selling insurance policies, announcing bonus or investments of premium. Public receiving such phone calls are requested to lodge a police complaint. |

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

Get Trusted Advice

Get Trusted Advice