Protect your loved ones through the Circle of Life.

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

Life is full of uncertainties. The COVID-19 pandemic has taught us that anything can happen to us at any time. Hence, we all need the assurance of term insurance plans to ensure that our loved ones continue to live peacefully even if something happens to us.

A 1 crore term insurance plan provides you a life insurance cover of ₹1 crore. This amount is paid to your nominee in the case of your death during the policy term. A 1 cr term insurance plan works like a guardian for your family members and helps them meet their financial needs even if you’re not there to support them.

You can buy your 1 crore term insurance plan from the convenience of your home or office. Below is the step-by-step guide for purchasing our 1 cr term insurance policy online:

With the PNB Mera Term Plan Plus , you have the option to opt for protection against death, disability, and disease. There are three options:·

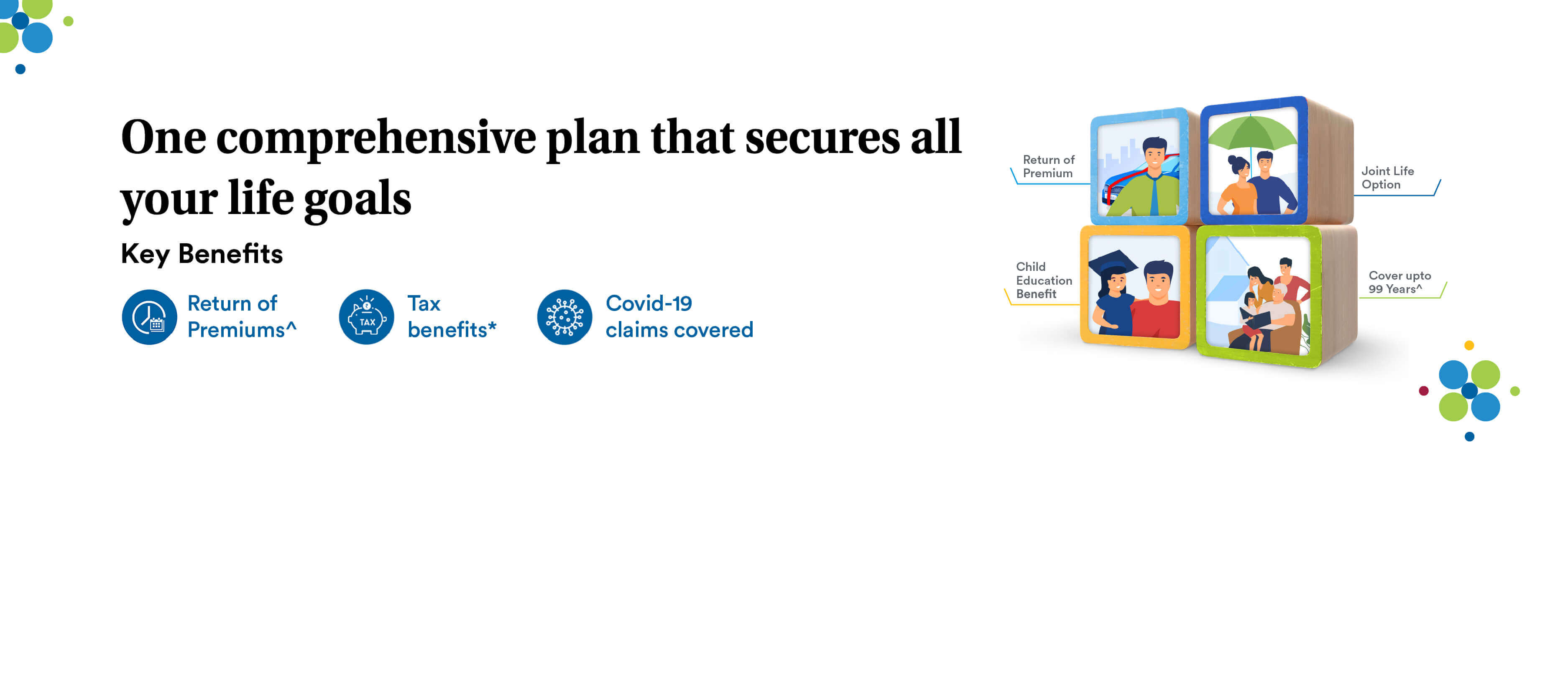

This plan includes Return of Premiums and spouse coverage and cover enhancement options, which include benefits like Life-stage sum assured Benefit, Step-up Sum Assured Benefit, and Child Education Support Benefit. These benefits are available on payment of extra premiums.

You can attach several riders to your PNB MetLife 1 crore term insurance plan. These riders enhance the coverage of your life insurance policy and ensure financial protection against a range of emergencies. The riders that you can include are:

| Age (years) | (Non-smoker/Male) | (Smoker/Male) | (Non-smoker/Female) | (Smoker/Female) |

| - | Rs(₹) | Rs(₹) | Rs(₹) | Rs(₹) |

| 20 | ₹7100 (40-year Term) | ₹9500 (40-year Term) | ₹6700 (40-year Term) | ₹8900 (40-year Term) |

| 30 | ₹9600 (30-year Term) | ₹13300 (30-year Term) | ₹8200 (30-year Term) | ₹11100 (30-year Term) |

| 40 | ₹15500 (20-year Term) | ₹22100 (20-year Term) | ₹12300 (20-year Term) | ₹17200 (20-year Term) |

| 50 | ₹26600 (10-year Term) | ₹38100 (10-year Term) | ₹21200 (10-year Term) | ₹30300 (10-year Term) |

| 60 | ₹61700 (15-year Term) | ₹89900 (15-year Term) | ₹49900 (15-year Term) | ₹72700 (15-year Term) |

The sum assured for the premiums mentioned above is ₹1 crore. The premiums are exclusive of taxes and calculated according to the regular premium payment mode. No riders have been included.

The minimum entry age for buying a 1 crore term insurance policy in India is 18 years, and the maximum entry age is 60 years annum. The minimum educational qualification required is 12th pass and above. Also, the minimum income criteria are ₹3lakh per annum for salaried and professional individuals like doctors, chartered accounts, etc., and ₹5 lakh for self-employed or business individuals.

Below is the list of documents you need to submit while buying a 1 cr term insurance policy

from PNB MetLife:

Before buying a term plan, it’s prudent to determine the exact coverage you may need. Below are the reasons you should opt for a 1 crore term insurance plan:·

At PNB MetLife, the claim process is very simple and hassle-free. You can register your claim by clicking here. For any claim-related queries, you can contact us at our toll-free claim helpline number 1800-425-6969. You can also get in touch by writing to us at claimshelpdesk@pnbmetlife.com.

Below is what makes PNB MetLife’s 1 crore Term Life Insurance Plan the best choice for you:

Life Cover

Protect your loved ones with a sum assured (ideally 7 times that of your annual income) even in your absence.

Riders

Get additional benefits in the form of health riders and protection against accidents, critical or serious illnesses.

Non-Linked plans

Term insurance plans are suitable to those who have a lower risk appetite as they are not linked to any market factors.

Affordable Premiums

Low premium rates set Term Insurance Plans apart from other life insurance plans. Non-smokers and women typically enjoy lower premiums.

Tax Benefits

Your life insurance policy can get you tax benefits from the moment you start paying premiums! Availing this benefit can help you save up to Rs. 1,50,000 from your taxes. However, you can claim this benefit only when the premiums paid don’t exceed 10% of the sum assured (under sec 80 C, I-T Act, 1961).

A 1 cr term insurance plan is a policy that provides life insurance cover of ₹1 crore to the policyholder. This sum assured is paid to the nominee in the case of the policyholder’s death during the policy term.

A 1 cr term plan is ideal for those who have many dependents and are the sole earning members of their families. In addition, individuals with huge debts or loans such as home loans or educational loans should also opt for a 1 cr term plan to cover their liabilities.

The claim settlement ratio is the ratio of the total number of claims settled by a company to the total number of claims filed by its customers. PNB MetLife has a claim settlement ratio of 98.17% for term insurance plans.

The minimum entry age for buying a 1 crore term insurance policy is 18 years, and the maximum entry age is 60 years.

Financial eligibility for the 1 cr term insurance plan will be dependent upon the earned income. The sources of earned income include salary, commission, bonuses, and business income. Generally, the earned income will not include rental income, pension, investment income, and rental income. The minimum income criteria are ₹3lakh per annum for salaried and professional individuals like doctors, chartered accounts, etc., and ₹5 lakh for self-employed or business individuals.

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

As your trusted life insurance partner, PNB MetLife covers COVID-19 claims. In the event of a death claim, please submit a signed claim form mentioning the policy number, a brief description of the insured event, and all other mandatory claim documents to the email addresses provided below. You may write to us at claimshelpdesk@pnbmetlife.com or indiaservice@pnbmetlife.co.in. For death claim intimation or any queries, you can also call us at 1800-425-6969 (for customers calling from within India only), Monday to Saturday, between 10:00 am and 7:00 pm

PNB MetLife Insurance, amongst the trusted Life Insurance companies in India, aims to provide a wide range of Life Insurance products that suits the needs of an individual at every stage of his life. Life Insurance Plans range from Term Life Insurance Plans, Term Plan, Protection Plans, Long Term Savings Plans , Retirement Plans & Child Education Plan.

Get Trusted Advice

Get Trusted Advice