Note on section 10(10D) of the Income-tax Act, 1961 (Act) with respect to Unit Linked Insurance Policy (ULIP) as amended by Finance Act, 2021

In Unit Linked Insurance Policy, the Investment Risk in investment portfolios is borne by the Policyholder

As per the provisions of section 10(10D) of the Income-tax Act, 1961 (Act), no exemption shall be available on any sum received under a life insurance policy, issued on or after 1 April 2012, where the premium payable for any of the previous year during the term of the policy exceeds 10 per cent of the actual capital sum assured.

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

Under the existing tax provisions of section 10(10D) of the Act, there is no cap on the amount of annual premium being paid by person during the term of the policy.

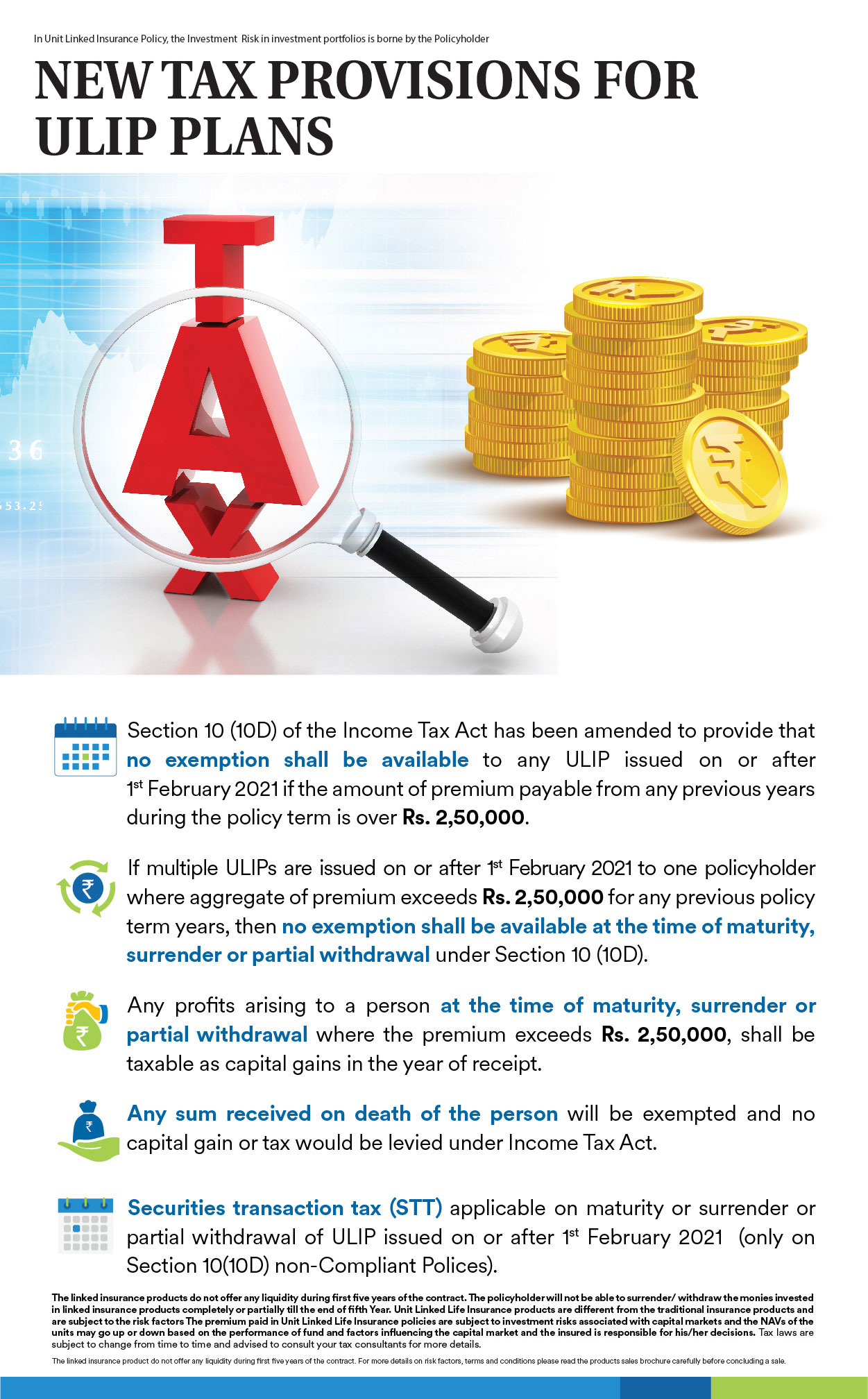

The Finance Act, 2021 amended section 10(10D) of the Act to provide that no exemption shall be available to any unit linked insurance policy (ULIP) issued on or after 1 February 2021 if the amount of premium payable for any of the previous year during the term of the policy exceeds Rs 2,50,000. As per the Amended fifth proviso to section 10(10D) of the Act, in case of multiple ULIPs issued on or after 1 February 2021, exemption under section 10(10D) shall be available only with respect to such policies aggregate premium whereof does not exceed Rs 2,50,000 for any of the previous years during the term of any of the policy.

The income tax is levied on all earning individuals who fall under a taxable income bracket. The income tax is paid to the Government of India and is charged annually. However, there are several tax deductions and exemptions that you can claim to lower your tax liability. The Income Tax Calculator helps you ascertain your tax output for a financial year based on your taxable income. This can help you plan well and save tax using the tax-saving deductions and exemptions, if possible.

To know more about term plan, term insurance, long term savings visit PNB MetLife website.

Disclaimer:

The above note prepared based on our interpretation of the relevant Finance Act, 2021 and applicable Income Tax provisions as on 31st March 2021. Tax laws are subject to change from time to time and Clients are advised to consult their tax consultants for more details. AD-F/2020-21/739

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

As your trusted life insurance partner, PNB MetLife covers COVID-19 claims. In the event of a death claim, please submit a signed claim form mentioning the policy number, a brief description of the insured event, and all other mandatory claim documents to the email addresses provided below. You may write to us at claimshelpdesk@pnbmetlife.com or indiaservice@pnbmetlife.co.in. For death claim intimation or any queries, you can also call us at 1800-425-6969 (for customers calling from within India only), Monday to Saturday, between 10:00 am and 7:00 pm.

PNB MetLife Insurance, amongst the trusted Life Insurance companies in India, aims to provide a wide range of Life Insurance products that suits the needs of an individual at every stage of his life. Life Insurance Plans range from Term Life Insurance Plans, Term Plan, Protection Plans, Long Term Savings Plans , Retirement Plans & Child Education Plan.

Get Trusted Advice

Get Trusted Advice