A life insurance can go to the extra mile and can provide more than just financial protection. Now ensure all your life goals are met at every stage.

A life insurance can go to the extra mile and can provide more than just financial protection. Now ensure all your life goals are met at every stage.

A life insurance can go to the extra mile and can provide more than just financial protection. Now ensure all your life goals are met at every stage.

A life insurance can go to the extra mile and can provide more than just financial protection. Now ensure all your life goals are met at every stage.

A life insurance can go to the extra mile and can provide more than just financial protection. Now ensure all your life goals are met at every stage.

A life insurance can go to the extra mile and can provide more than just financial protection. Now ensure all your life goals are met at every stage.

A life insurance can go to the extra mile and can provide more than just financial protection. Now ensure all your life goals are met at every stage.

A life insurance can go to the extra mile and can provide more than just financial protection. Now ensure all your life goals are met at every stage.

A life insurance can go to the extra mile and can provide more than just financial protection. Now ensure all your life goals are met at every stage.

A life insurance can go to the extra mile and can provide more than just financial protection. Now ensure all your life goals are met at every stage.

Over the past two decades, as a leading insurance provider in India, we have been responsible for the financial protection of countless families at every stage of their lives.

We use cookies to provide you with a great user experience. By using the website, you accept our use of cookies.

No Results

No Results

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

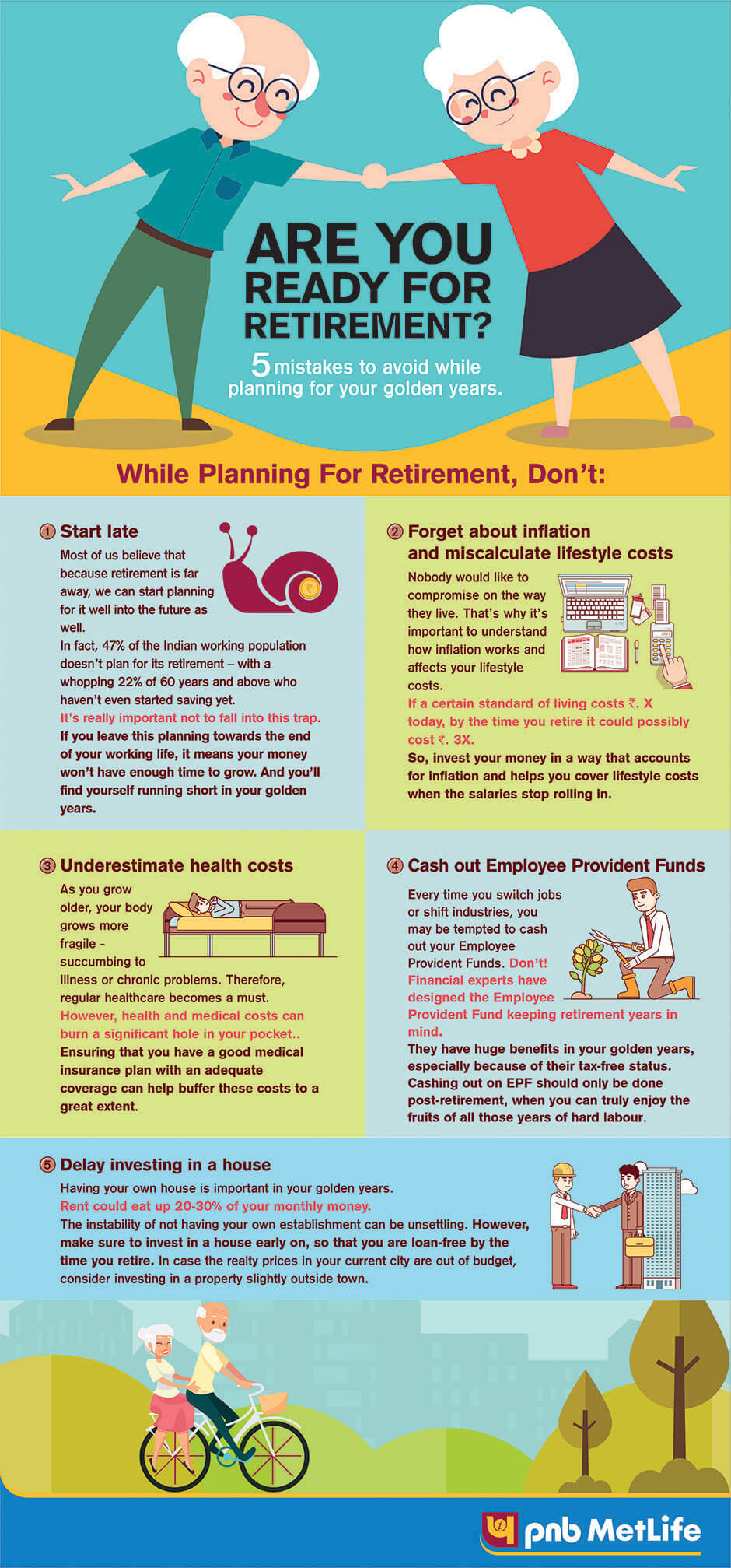

How does one picture retirement? A nice long vacation? Not bothering about answering work-related calls? Sipping on your favourite beverage by a swimming pool? These are all pretty pictures, ones you think about with enthusiasm. But that enthusiasm soon turns into anxiety as you inch closer to retirement. The question you are now harrowed by is – ‘Who’s going to pay for all these lavish dreams once I retire?

It’s a question one should ask oneself more often. After all, you’ve got to have it all figured out for when the paychecks stop. Retirement planning is challenging. For your benefit, here’s an easy-to-remember infographic that highlights the 5 most common mistakes to avoid while making retirement plans. Following this can ensure that your golden years are secure, sunshine-y and happy. After all, you’ve worked hard to earn it.

Finally, the best way to make sure your retirement years are relaxed, is to invest in a good retirement life insurance plan. Retirement plans help you put some money aside right from the very start of your career, without any financial pressure at all. That way, you pay a lower premium, gain higher returns and your money matures enough to cover all the other factors mentioned earlier.

So why leave the planning for later? Start today, be prepared and retire happily. You deserve it!

Doesn’t the thought of retirement sound blissful? No work, no deadlines, and all your hours spent doing the things you love, like travel, painting, and even napping in the afternoon! If you want your retirement to be what you have always dreamed of, start retirement planning now and save a considerable retirement corpus in time. The online Retirement Calculator can help you plan your future financial goals and ensure you achieve them within the stipulated time.

*Statistics Source: Business Today

RETIREMENT

The retirement years can be a wonderful period in life when planned properly. You can sit back, relax, travel, rest and do whatever you want with a...

RETIREMENT

Two major things to consider when considering the types of insurance available to you:...

RETIREMENT

As you begin to think about your retirement planning, take the time to consider some important questions....

RETIREMENT

Life insurance is often misconceived as a product suitable only for the working population. This couldn’t be farther from the truth. As you can ded...

RETIREMENT

Building a retirement nest is easy if you use your pre-retirement years well. We share 5 tips.. It is every person’s dream to have a peaceful reti...

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

As your trusted life insurance partner, PNB MetLife covers COVID-19 claims. In the event of a death claim, please submit a signed claim form mentioning the policy number, a brief description of the insured event, and all other mandatory claim documents to the email addresses provided below. You may write to us at claimshelpdesk@pnbmetlife.com or indiaservice@pnbmetlife.co.in. For death claim intimation or any queries, you can also call us at 1800-425-6969 (for customers calling from within India only), Monday to Saturday, between 10:00 am and 7:00 pm.

PNB MetLife Insurance, amongst the trusted Life Insurance companies in India, aims to provide a wide range of Life Insurance products that suits the needs of an individual at every stage of his life. Life Insurance Plans range from Term Life Insurance Plans, Term Plan, Protection Plans, Long Term Savings Plans , Retirement Plans & Child Education Plan.

Get Trusted Advice

Get Trusted Advice