RETIREMENT

Life insurance is imperative as a safeguard against the uncertainties that hover around us all the while. Human life is fragile and subject to risks of death and disability due to natural and accidental causes, unfortunate events that have financial ramifications. Thus, life insurance is crucial to ensure that your immediate family doesn’t have to break financially too, in the event of your demise, to facilitate you in securing a constant source of income after retirement and to provide for other financial contingencies.

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

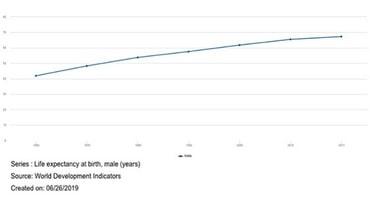

Life insurance is often misconceived as a product suitable only for the working population. This couldn’t be farther from the truth. As you can deduct from the purpose that life insurance serves, even retired life can bring with it the need for this protection. Thus, even senior citizens, usually defined as those aged 60 and above, may have financial liabilities and obligations, owing to the changing demographics and lifestyle choices. Additionally, the elderly population in India is also rising due to increased life expectancy rates. For instance, India’s life expectancy rates for males have been on consistent rise, standing at 67.3 years as of 2017, against 41.9 in 1960:

Understanding term life insurance for senior citizens

A term life insurance plan is a purely protection based insurance plan whereby the beneficiary of the insured is provided with financial coverage for a ‘term’ or a ‘specific period of time,’ in either a lump sum amount or in the form of monthly payouts as decided upon by the policyholder.

Life insurance is still in its nascent stage on the senior citizen tangent. Because term insurance is often looked upon as a product availed by someone whose death would be untimely, it is taken for granted that people might need it even after a certain age, or say, after retirement. However, insurance providers now have provision for all age brackets as far as 99 years - which means that affordable term insurance plans are available for senior citizens too. Of course, the decision to buy term life insurance at this age should be taken very prudently, since the insurance premium at this age is expensive than what you would pay at a younger age, but there are scenarios where it is in fact, a wise thing to do. Let’s take a peek at such scenarios when senior citizens should opt for term plans:

Case 1: Dependents

If your kids are financially dependent on you when you reach the age of 60, that justifies taking an insurance policy. It isn’t uncommon for people to plan families such that kids are born later than they used to, meaning that they could still be studying when you reach the threshold of 60 years.

Case 2: If you want your spouse to be financially empowered

Term insurance also makes sense when you will be survived by your spouse who won’t have a family pension to fall back on. Buying term life insurance, in this case, ensures that your spouse can stay independent.

Case 3: Engaged in work, post-retirement

If you are still working post-retirement, it would be worth taking a policy because, in case of your death, this money can help uphold your family’s lifestyle.

Case 4: To pay off debts and liabilities

Usually, major loans stretch for a long time period and may still be on as you reach 60 years of age. If you are under any sort of debt, it makes sense to get term insurance so that this amount can be used to pay your outstanding debts.

Case 5: To unburden your heirs from immediate costs

You may want to avail a term life insurance if you think of this amount as an inheritance for your kids, and if you want to take off the burden of funeral expenses, property taxes for your assets, legal fees etc. from their shoulders.

Thus, if you don’t want your dependents and family to suffer more than they emotionally have to, in the event of your death, then the wise thing is to have a term insurance policy in place, even as a senior citizen.

You can choose a term plan that suits your family’s lifestyle and financial needs, and you can buy an online term plan with just a few clicks, sans any lengthy or tedious paperwork.

Doesn’t the thought of retirement sound blissful? No work, no deadlines, and all your hours spent doing the things you love, like travel, painting, and even napping in the afternoon! If you want your retirement to be what you have always dreamed of, start retirement planning now and save a considerable retirement corpus in time. The online Retirement Calculator can help you plan your future financial goals and ensure you achieve them within the stipulated time.

Protect yourself against the uncertainties in your life and start planning for retirement today. Explore various insurance plan options such as health insurance, term insurance and life insurance at PNB MetLife.

Source:

https://databank.worldbank.org/reports.aspxsource=2&series=SP.DYN.LE00.MA.IN&country=IND

Disclaimer:

The aforesaid article presents the view of an independent writer who is an expert on financial and insurance matters. PNB MetLife India Insurance Co. Ltd. doesn’t influence or support views of the writer of the article in any way. The article is informative in nature and PNB MetLife and/ or the writer of the article shall not be responsible for any direct/ indirect loss or liability or medical complications incurred by the reader for taking any decisions based on the contents and information given in article. Please consult your financial advisor/ insurance advisor/ health advisor before making any decision.

PNB MetLife India Insurance Company Limited, Registered office address: Unit No. 701, 702 & 703, 7th Floor, West Wing, Raheja Towers, 26/27 M G Road, Bangalore -560001, Karnataka.

IRDAI Registration Number 117. CI No: U66010KA2001PLC028883. For more details on risk factors, terms and conditions, please read the sales brochure carefully before concluding the sale.

The marks “PNB” and “MetLife” are registered trademarks of Punjab National Bank and Metropolitan Life Insurance Company, respectively. PNB MetLife India Insurance Company Limited is a licensed user of these marks.

Call us Toll-free at 1-800-425-6969.. Phone: 080-66006969, Website: www.pnbmetlife.com, Email: indiaservice@pnbmetlife.co.in or Write to us: 1st Floor, Techniplex -1, Techniplex Complex, Off Veer Savarkar Flyover, Goregaon (West), Mumbai – 400062, Maharashtra. Phone: +91-22-41790000, Fax: +91-22-41790203

EC153 LD/2019-20/154

BEWARE OF SPURIOUS/FRAUD PHONE CALLS!

• IRDAI is not involved in activities like selling policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint.

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

As your trusted life insurance partner, PNB MetLife covers COVID-19 claims. In the event of a death claim, please submit a signed claim form mentioning the policy number, a brief description of the insured event, and all other mandatory claim documents to the email addresses provided below. You may write to us at claimshelpdesk@pnbmetlife.com or indiaservice@pnbmetlife.co.in. For death claim intimation or any queries, you can also call us at 1800-425-6969 (for customers calling from within India only), Monday to Saturday, between 10:00 am and 7:00 pm.

PNB MetLife Insurance, amongst the trusted Life Insurance companies in India, aims to provide a wide range of Life Insurance products that suits the needs of an individual at every stage of his life. Life Insurance Plans range from Term Life Insurance Plans, Term Plan, Protection Plans, Long Term Savings Plans , Retirement Plans & Child Education Plan.

Get Trusted Advice

Get Trusted Advice