Buying life insurance is like having a safety net for all your life. With a wide variety of policies, it is not difficult to find one that is well-suited to your needs.

But, when buying an insurance policy of this type, paying attention to the claim settlement ratio of your insurer should be one of your top priorities Why?

Let us know what a claim settlement ratio is, its importance, why you should consider it, and how it works.

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

It is the ratio of insurance claims successfully settled by the insurer compared to the claims raised by the policyholders or their nominees.

Let us try to understand this with an example. Suppose a life insurance provider has a CSR (Claim Settlement Ratio) of 85% then if a company has 100 death claims requests in a year (including carry forwarded cases of the previous year), then it has settled 85 claims successfully.

An insurance company having the best claim settlement ratio in life insurance may have a good history of honouring claims and allowing the policyholder to get much-needed financial help in an emergency.

Claim Settlement Ratio is one of the most important factors that ensure a trouble-free claim settlement process. A high CSR means that an insurer is efficient in settling claims of most of the policyholders, which, in turn, signifies the reliability of the insurance company.

There are many benefits of choosing an insurer that has a high claim settlement ratio; some of them are:

IRDAI (Insurance Regulatory and Development Authority) issues the claim settlement ratios of all life insurance providers every year.

The data released by this authority helps people who want to buy a life insurance policy to get a transparent overview of the insurer's performance and consistency in settling claims throughout the years.

The formula for calculating claim settlement ratios is as follows:

CSR= (Total number of claims settled during the year/ (Total number of claims received during the year + Claims Outstanding at the beginning of the year)*100

There is no particular percentage of a good CSR. However, insurers having a CSR exceeding 90% are chosen by many people.

This is because:

A claim settlement ratio is more than just a number. It is a complete picture of an insurance company’s efficiency in satisfying its customers by processing their claims promptly.

Term insurance claim settlement ratio helps in navigating through the confusing world of insurance as choosing an insurance policy is a daunting task.

An insurance company with a high CSR is considered to be an ideal choice as it highlights the financial stability and credibility of the insurer along with ensuring that your chosen insurer has a smooth life insurance claim process.

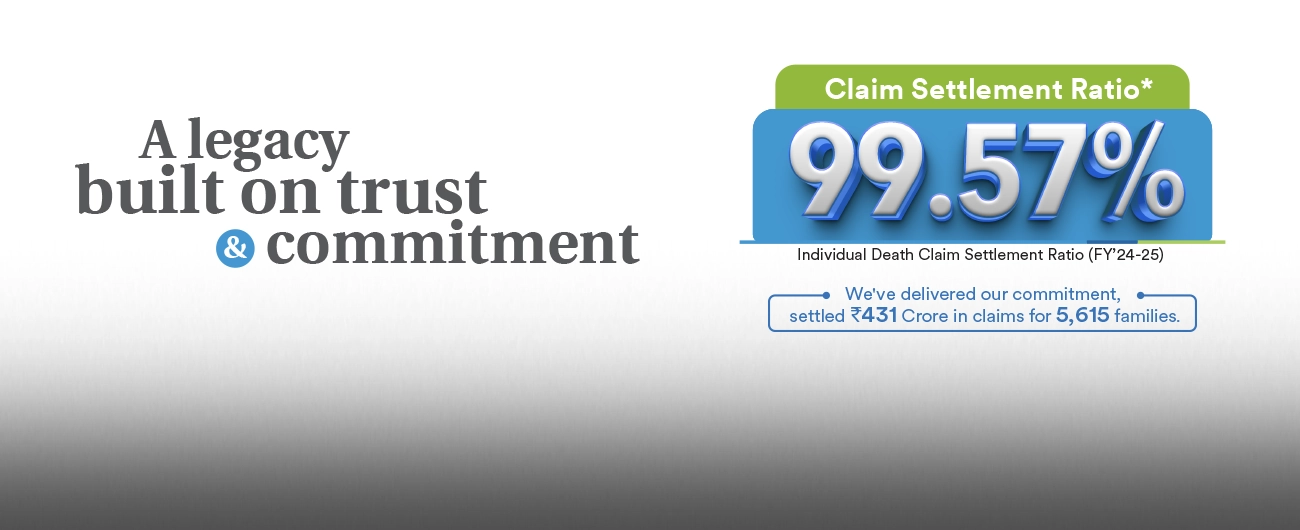

PNB MetLife offers an extensive range of life insurance plans suitable for retirement, child education, and several other situations for which you need to have guaranteed financial protection. Moreover, PNB MetLife's claim settlement ratio stands at an impressive 99.57%.

To find the claim settlement ratio of an insurance company, you should visit the official IRDAI website or the website of your chosen insurer.

Once all the required necessary documents are received by PNB MetLife, we will process your claim within 30 days of receipt from the date of receipt of last necessary document for all cases where further investigation is not required. Wherein Investigation is required, investigation should be completed not later than 90 days from the date of receipt of claim intimation and the claim shall be decision within 30 days thereafter.

You can raise a claim by filling out the claim form, attaching the necessary documents, and submitting these to your insurer. If the insurer finds your request valid, he will settle your claim in the stipulated time.

Disclaimer:

Claims Settlement Ratio banner - *As per latest annual audited figures reported to IRDAI for FY 24-25. PNB MetLife India Insurance Company Limited, Registered office address: Unit No. 701, 702 & 703, 7th Floor, West Wing, Raheja Towers, 26/27 MG Road, Bangalore -560001, Karnataka. IRDAI Registration number 117. CI No: U66010KA2001PLC028883. The marks "PNB" and "MetLife" are registered trademarks of Punjab National Bank and Metropolitan Life Insurance Company, respectively. PNB MetLife India Insurance Company Limited is a licensed user of these marks. Email: indiaservice@pnbmetlife.co.in or Write to us: 1st Floor, Techniplex-1, Techniplex Complex, off Veer Savarkar Flyover, Goregaon (West), Mumbai - 400062, Maharashtra. AD-F/2025-26/271

The aforesaid article presents the view of an independent writer who is an expert on financial and insurance matters. PNB MetLife India Insurance Co. Ltd. doesn’t influence or support views of the writer of the article in any way. The article is informative in nature and PNB MetLife and/ or the writer of the article shall not be responsible for any direct/ indirect loss or liability or medical complications incurred by the reader for taking any decisions based on the contents and information given in article. Please consult your financial advisor/ insurance advisor/ health advisor before making any decision.

PNB MetLife India Insurance Company Limited Registered office address: Unit No. 701, 702 & 703, 7th Floor, West Wing, Raheja Towers, 26/27 M G Road, Bangalore -560001, Karnataka

IRDAI Registration number 117 | CIN U66010KA2001PLC028883

Terms & conditions apply, Benefits stipulated are subject to premiums paid and policies in-force. For more details on risk factors, please read the sales brochure and the terms and conditions of the policy, carefully before concluding the sale.

Tax benefits are as per the Income Tax Act, 1961, & are subject to amendments made thereto from time to time. Please consult your tax consultant for more details.

Goods and Services Tax (GST) shall be levied as per prevailing tax laws which are subject to change from time to time.

The marks "PNB" and "MetLife" are registered trademarks of Punjab National Bank and Metropolitan Life Insurance Company, respectively. PNB MetLife India Insurance Company Limited is a licensed user of these marks.

Call us Toll-free at 1-800-425-6969, Website: www.pnbmetlife.com, Email: indiaservice@pnbmetlife.co.in or Write to us: 1st Floor, Techniplex -1, Techniplex Complex, Off Veer Savarkar Flyover, Goregaon (West), Mumbai – 400062, Maharashtra.

Beware of Spurious Phone Calls and Fictitious / Fraudulent Offers! |

AD-F/2024-25/359

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

As your trusted life insurance partner, PNB MetLife is with you amidst the current COVID-19 outbreak. Our policies also cover COVID-19 Claims. In case of a Death Claim, kindly submit the signed Claim Intimation Letter mentioning the policy number, brief of the insured event and other claim documents on the email mentioned herewith. Please write-in to us at claimshelpdesk@pnbmetlife.com or indiaservice@pnbmetlife.co.in. You can also call us on 1800-425-6969 for death claims intimations and for any queries on Monday - Saturday between 10:00 am - 7:00 pm.

PNB MetLife Insurance, amongst the trusted Life Insurance companies in India, aims to provide a wide range of Life Insurance products that suits the needs of an individual at every stage of his life. Life Insurance Plans range from Term Life Insurance Plans, Term Plan, Protection Plans, Long Term Savings Plans , Retirement Plans & Child Education Plan.

Get Trusted Advice

Get Trusted Advice