Zoya, a 45-year-old corporate professional, was surfing the internet to find the most suitable life insurance provider when she received her health checkup report via email. Curious, she checked the summary. The majority of the results indicated normalcy, but a bold number on her lipid profile report caught her attention– a cholesterol ratio of 7.

A wave of questions flooded her mind - 'What does that mean?' 'How did it come up?' 'How will it impact my lifestyle?' 'Is my heart at risk?' 'Will I still be eligible for life insurance?’.

Zoya found herself in a sea of uncertainties, her mind racing with concerns.

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

Seeking clarity, Zoya promptly scheduled an appointment with Dr. Patel, her trusted family physician. Recognizing Zoya's curiosity and confusion, Dr. Patel patiently explained the concept of cholesterol ratio. He clarified that cholesterol ratio is a measure of the balance between 'good' and 'bad' cholesterol in your blood.

Think of it like comparing teams in a game. 'Good' cholesterol (HDL) is the team defending your heart, while 'bad' cholesterol (LDL) is the team that can cause trouble. The cholesterol ratio is the score between the 'good' and 'bad' cholesterol teams in your blood.

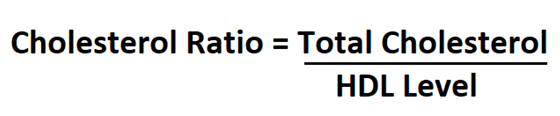

To find this score, you divide your total cholesterol number by your HDL cholesterol number. For instance, if your total cholesterol is 220 mg/dL and your HDL is 60 mg/dL, your ratio would be around 3.7-to-1.

The lower the ratio, the better because it means your heart's defence team is doing a good job. If the ratio is higher, it might suggest a higher risk of heart issues. Keeping this ratio in check is like keeping a good balance in the game for a healthier heart.

Zoya learned that the ratio of 7 indicated a higher than desirable level, potentially increasing her risk of heart-related issues. Dr. Patel emphasised the role of genetics, diet, and lifestyle choices in influencing cholesterol levels.

Just as Zoya did, a straightforward blood test called a lipid profile can assess your cholesterol levels. If the report doesn't explicitly mention the ratio, you can effortlessly calculate it using the following formula.

Alternatively, you may opt for online cholesterol ratio calculators.Health experts categorise the cholesterol ratio into three main categories.

The table below to find the dangerous, at-risk, and normal range of cholesterol levels:

| Total Cholesterol | LDL Cholesterol | HDL Cholesterol | Cholesterol Level | |

| Male | Female | |||

| 240 and higher | 160 and higher | Under 40 | Under 50 | Dangerous |

| 200-239 | 100-159 | 40-49 | 50-59 | At-Risk |

| Under 200 | Under 100 | 60 and higher | Heart Healthy | |

A high cholesterol ratio increases the risk of cardiovascular diseases, including heart attacks and strokes, as well as other complications, such as peripheral artery disease, high blood pressure, type 2 diabetes, pancreatitis, and gallstones.

You should proactively discuss your test results with your trusted health professional to get an in-depth understanding of your health. Engage in a conversation about the necessary measures to maintain a balanced cholesterol level.

This frequency can vary from person to person based on factors such as current cholesterol levels, family history, age, lifestyle, and any existing symptoms.

Cholesterol and BMI (body mass index) are both indicators of your cardiovascular health. Despite being separate metrics, they can have an impact on one another and the general state of well-being. You can figure out your BMI by applying the BMI formula or with the Body Mass Index Calculator (BMI Calculator).

Levels of cholesterol and BMI:

High BMI and Cholesterol: People with a higher BMI, particularly those who fall into the overweight or obese category, are more likely to have high cholesterol. Frequently eating unhealthy food and not moving enough can make the ‘bad’ cholesterol go up and the ‘good’ cholesterol go down, especially if you have a higher BMI.

Low BMI and Cholesterol: Conversely, those who have a low BMI may think they are inherently less risky, although this isn't necessarily the case. If a person has other risk factors or eats a diet heavy in saturated fats, they may still have harmful cholesterol levels even though their BMI is normal or low.

Diet and Lifestyle: Dietary choices and lifestyle decisions have an impact on cholesterol ratio as well as BMI. High cholesterol and a high BMI can both be caused by a diet heavy in trans and saturated fats such as fried foods, processed snacks, butter, and fatty cuts of meat.

Physical Activity: Consistent physical activity can help lower cholesterol and maintain a healthy BMI. It is well known that exercise increases HDL cholesterol and enhances cardiovascular health in general.

Collective Impact: Adverse cholesterol levels frequently constitute metabolic syndrome that increases the risk of stroke, heart disease, and type 2 diabetes. Managing both BMI and cholesterol is crucial for maintaining optimal cardiovascular health.

While BMI and cholesterol are connected, it's vital to remember that many other factors also play a role in overall health. BMI is not considered an ideal health indicator in India as it primarily focuses on body weight, whereas the more critical factor for health is body fat.

For personal guidance based on unique health profiles, always seek the assistance of healthcare professionals.

Let's go back to Zoya's journey of figuring out what having high cholesterol really means and how it might affect her. Zoya resumed her quest for the most suitable life insurance plan. Contacting several insurance providers, she discussed her requirements and provided the necessary details. To her surprise, she discovered that her high cholesterol level influenced her insurance premium.

Different insurance companies have varied policies regarding cholesterol ratios, and the acceptable cholesterol levels for life insurance also differ, as does what is considered high cholesterol for life insurance.

However, by now, Zoya was well aware that high cholesterol issues reduce overall health quality and increase the risk of critical conditions such as cardiovascular diseases, strokes, and type-2 diabetes. Recognising the fundamental principle that life insurance is designed to cover risks, Zoya understood that higher risks often translate to higher

premiums.

She discovered that several other factors also contributed to the determination of the risk level by insurance companies. This realisation prompted her to read the policies of each company carefully before making a final decision on her life insurance provider.

PNB MetLife offers a Life Insurance calculator so you can calculate your insurance premium and insurance coverage effortlessly.

With her curiosity and awareness, Zoya realised that the claim of individuals with a high cholesterol ratio not being eligible for life insurance is a clear myth. However, with a higher health risk involved, she may be charged a higher insurance premium. She realised that insurance options vary, and it's crucial to explore different companies and policies.

Understanding the impact of your cholesterol ratio on life insurance premiums is a crucial step toward informed decision-making. By debunking myths, seeking transparency, and exploring options with trusted insurance providers.

Life's unpredictable events may unfold unexpectedly. Take a proactive step towards financial security by exploring the diverse range of insurance options offered by PNB MetLife. Choose the policies that best align with your and your loved ones' needs. Explore our policies now.

Disclaimer:

The aforesaid article presents the view of an independent writer who is an expert on financial and insurance matters. PNB MetLife India Insurance Co. Ltd. doesn’t influence or support views of the writer of the article in any way. The article is informative in nature and PNB MetLife and/ or the writer of the article shall not be responsible for any direct/ indirect loss or liability or medical complications incurred by the reader for taking any decisions based on the contents and information given in article. Please consult your financial advisor/ insurance advisor/ health advisor before making any decision.

PNB MetLife India Insurance Company Limited

Registered office address: Unit No. 701, 702 & 703, 7th Floor, West Wing, Raheja Towers, 26/27 M G Road, Bangalore -560001, Karnataka

IRDAI Registration number 117 | CIN U66010KA2001PLC028883

For more details on risk factors, please read the sales brochure and the terms and conditions of the policy, carefully before concluding the sale.

Tax benefits are as per the Income Tax Act, 1961, & are subject to amendments made thereto from time to time.

Please consult your tax consultant for more details.

Goods and Services Tax (GST) shall be levied as per prevailing tax laws which are subject to change from time to time.

The marks "PNB" and "MetLife" are registered trademarks of Punjab National Bank and Metropolitan Life Insurance Company, respectively. PNB MetLife India Insurance Company Limited is a licensed user of these marks.

Call us Toll-free at 1-800-425-6969, Website: www.pnbmetlife.com, Email: indiaservice@pnbmetlife.co.in or Write to us: 1st Floor, Techniplex -1, Techniplex Complex, Off Veer Savarkar Flyover, Goregaon (West), Mumbai – 400062, Maharashtra.

Beware of Spurious Phone Calls and Fictitious / Fraudulent Offers! |

AD-F/2023-24/927

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

As your trusted life insurance partner, PNB MetLife covers COVID-19 claims. In the event of a death claim, please submit a signed claim form mentioning the policy number, a brief description of the insured event, and all other mandatory claim documents to the email addresses provided below. You may write to us at claimshelpdesk@pnbmetlife.com or indiaservice@pnbmetlife.co.in. For death claim intimation or any queries, you can also call us at 1800-425-6969 (for customers calling from within India only), Monday to Saturday, between 10:00 am and 7:00 pm.

PNB MetLife Insurance, amongst the trusted Life Insurance companies in India, aims to provide a wide range of Life Insurance products that suits the needs of an individual at every stage of his life. Life Insurance Plans range from Term Life Insurance Plans, Term Plan, Protection Plans, Long Term Savings Plans , Retirement Plans & Child Education Plan.

Get Trusted Advice

Get Trusted Advice