When thinking about health and financial planning, body weight and overall health play a significant role. One of the simplest tools for assessing your health is the BMI calculator. A Body Mass Index (BMI) calculator helps individuals understand whether their weight is in a healthy range based on their height. Although BMI isn’t a perfect metric, it is widely used in both the healthcare and insurance industries to gauge health risks and set premiums for life and health insurance.

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

This blog delves deep into how you can use a BMI calculator to evaluate your health and how it can impact your life insurance needs, costs, and overall financial planning. By understanding your BMI and its implications, you can make proper decisions for your health and future.

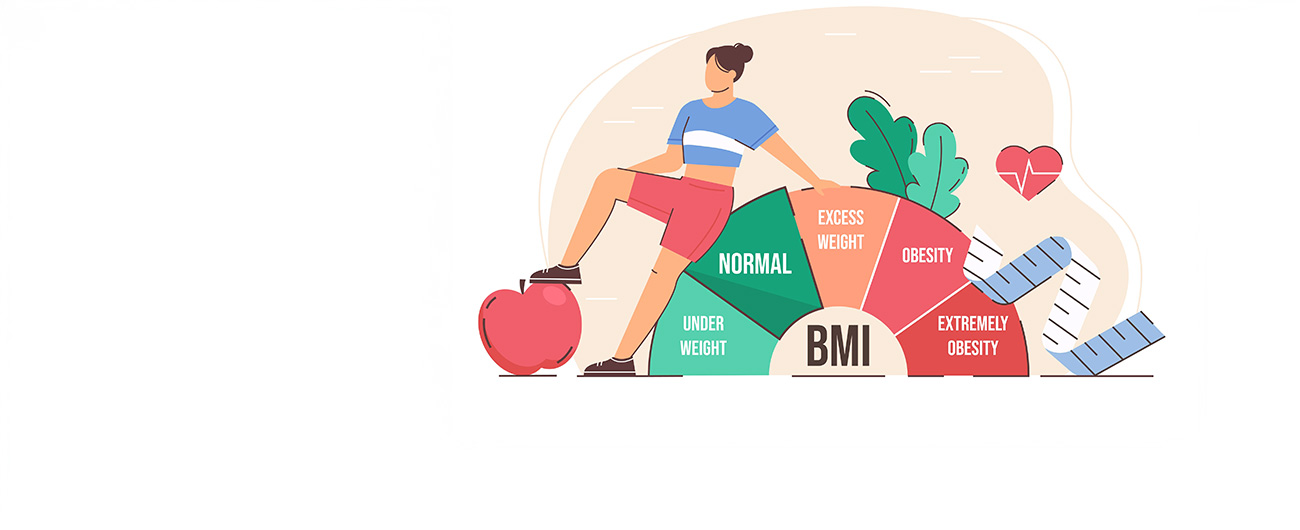

Body Mass Index (BMI) is a formula that uses your height and weight to estimate body fat. Though it doesn’t measure body fat directly, it’s an easy and widely adopted method to classify individuals into categories such as underweight, normal weight, overweight, and obese. The BMI formula is simple: it's your weight divided by your height. Once you calculate your BMI, you can place yourself into one of these categories:

BMI helps to indicate a person’s body fat. According to the person's position on BMI, it can be ascertained if it presents a risk to their health. The BMI calculator is essential for determining an individual's level of health. In addition to being a useful tool for evaluating an individual's health, it serves as a "Obesity Indicator." The public can benefit from the BMI calculator in many ways:

Although a person's BMI cannot accurately predict their health on its own, it can provide some insight. Both your sum assured, and the premium amount may be greatly impacted if you have a high or very-high risk profile. Insurance companies use the same computation and BMI ranges to estimate a person's health risk regardless of gender, despite the fact that the basic anatomy of a male and female body differs greatly. This is because there are no different BMI index ranges for male and female bodies.

Insurance companies use various health metrics to assess the risk a person poses to the insurer. One of the primary metrics they consider is your BMI. Since BMI is linked to several health risks, insurers use it to determine your health insurance premiums.

Both health and life insurance are critical components of a long-term financial strategy. Understanding how your BMI affects these policies can help you make informed decisions. For instance, choosing a life insurance policy early, while your BMI is in a healthy range, can help you lock in lower premiums for the future. A BMI calculator is a simple yet powerful tool for planning both health and life insurance needs. As a planning tool, the BMI calculator allows you to make proactive decisions for both your physical well-being and your financial future. Whether you're applying for health insurance or life insurance, knowing your BMI and understanding how it influences your premiums and coverage is essential.

Disclaimer:

The aforesaid article presents the view of an independent writer who is an expert on financial and insurance matters. PNB MetLife India Insurance Co. Ltd. doesn’t influence or support views of the writer of the article in any way. The article is informative in nature and PNB MetLife and/ or the writer of the article shall not be responsible for any direct/ indirect loss or liability or medical complications incurred by the reader for taking any decisions based on the contents and information given in article. Please consult your financial advisor/ insurance advisor/ health advisor before making any decision.

PNB MetLife India Insurance Company Limited

Registered office address: Unit No. 701, 702 & 703, 7th Floor, West Wing, Raheja Towers, 26/27 M G Road, Bangalore -560001, Karnataka

IRDAI Registration number 117 | CIN U66010KA2001PLC028883

For more details on risk factors, please read the sales brochure and the terms and conditions of the policy, carefully before concluding the sale.

Tax benefits are as per the Income Tax Act, 1961, & are subject to amendments made thereto from time to time.

Please consult your tax consultant for more details.

Goods and Services Tax (GST) shall be levied as per prevailing tax laws which are subject to change from time to time.

The marks "PNB" and "MetLife" are registered trademarks of Punjab National Bank and Metropolitan Life Insurance Company, respectively. PNB MetLife India Insurance Company Limited is a licensed user of these marks.

Call us Toll-free at 1-800-425-6969, Website: www.pnbmetlife.com, Email: indiaservice@pnbmetlife.co.in or Write to us: 1st Floor, Techniplex -1, Techniplex Complex, Off Veer Savarkar Flyover, Goregaon (West), Mumbai – 400062, Maharashtra.

Beware of Spurious Phone Calls and Fictitious / Fraudulent Offers! |

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

Get Trusted Advice

Get Trusted Advice