By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

A New Fund is a fund that gets launched in a market and is available at an introductory NAV which is usually Rs. 10 during the launch period. In case of Life Insurance companies launching a new fund, this fund is available among other existing funds and can be availed only by buying a Unit Linked Life Insurance Plan (ULIP). ULIP as the name suggests helps in getting the market-linked returns on the investment component of the premiums post deductions of the charges and also provides a life cover that helps you protect your family from life’s uncertainties.

Systematic and Rule-based Investing Investment + Life Cover

Tax Benefit up to ₹ 46,800

PNB MetLife Bharat Manufacturing Fund is going to be an actively managed equity fund and its returns will be benchmarked against NIFTY India Manufacturing Index.

An actively managed fund is a fund where a manager is involved in making decisions about what stocks and bonds to buy or sell, and when to do so. The manager's goal is to outperform a benchmark or index relevant to the manufacturing fund's investment mandate.

Actively managed funds can potentially provide higher returns than passive funds, but they also come with higher costs and risks. The optimal investment strategy for you will depend on your financial goals, risk tolerance, and investment horizon.

PNB MetLife’s investment team is of high repute and known for their stellar performance for delivering high returns to our customers.

Most of our equity funds have delivered higher returns than the benchmark returns and 99% of our equity funds are rated either 4 or 5 star by a reputed rating agency – Morning Star.

| Equity Scheme Name | Cap | 3 Year (CAGR) | 5 Year (CAGR) | Overall Morningstar Rating1 | ||

|---|---|---|---|---|---|---|

| NAV Return |

Benchmark | NAV Return |

Benchmark | |||

| Mid Cap | Mid Cap | 32.60% | 29.00% | 32.80% | 21.60% | ⭐⭐⭐⭐⭐ |

| CREST (Thematic) | Multi Cap | 25.60% | 17.90% | 22.30% | 17.40% | ⭐⭐⭐⭐⭐ |

| Premier Multi-Cap | Multi Cap | 25.30% | 18.40% | 24.40% | 18.40% | ⭐⭐⭐⭐⭐ |

| Multiplier III | Large Cap | 22.40% | 15.20% | 22.10% | 15.30% | ⭐⭐⭐⭐⭐ |

| Flexi Cap | Large Cap | 19.60% | 17.60% | 18.20% | 17.70% | ⭐⭐⭐⭐ |

As on 30th June 2024

This Independence Day, we celebrate the one-year anniversary of PNB MetLife Bharat Manufacturing Fund, hear from Sanjay Kumar, our Chief Investment Officer at PNB MetLife, on the fund's potential and its role in powering India’s manufacturing sector.

| Index Returns | NIFTY 50 | NIFTY India Manufacturing Index |

|---|---|---|

| 5 years Price Returns | 15.29% | 25.31% |

NIFTY India Manufacturing Index has delivered significantly higher returns than NIFTY 50.

If you had invested Rs. 10,000 per month starting 1st April 2005 in NIFTY India Manufacturing Index, then your total investment of Rs. 23.1 Lakhs made till 1st June 2024 (231 months) would have become Rs. 1.15 Crore as on 30th June 2024.

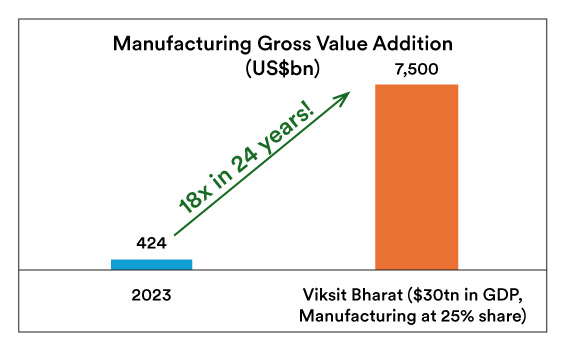

Manufacturing Sector is expected to grow 18 times in next 24 years

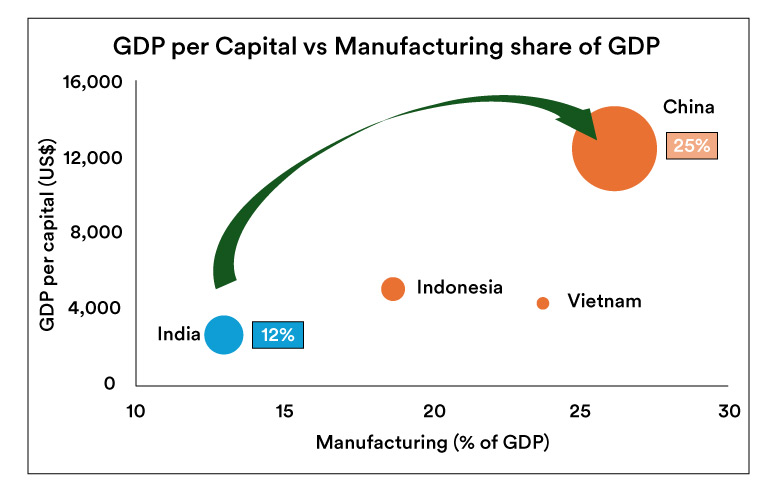

India aims to be a developed economy by 2047 (Amrit Kaal) with a 30 Trillion Dollar as its GDP. Much of this growth is expected to be driven by Manufacturing Sector. Currently Manufacturing Sector contributes 12% to the GDP but it is expected to increase to 25% by 2047. For this to happen, manufacturing sector is expected to grow 18 times in next 24 years.

Source: RBI, Niti Aayog, Media Reports

Source: IMF, Bloomberg

Scaling up 10-plus of India’s manufacturing value chains could produce $320 billion more in gross value added.

There are multiple enablers in place to support the growth of the manufacturing sector

Other enablers like Infrastructure development and import substitution give further impetus to the manufacturing sector. Whether it is roadways, railways or airways, India is already rapidly strengthening on this front and ensuring all-round connectivity. Companies like Apple produced $14 bn worth of iPhones in India over the last fiscal year, a sign of the company’s continued effort to manufacture more devices outside of China. Apple now makes around 1 in 7, or 14%, of its iPhones in India, twice the amount it produced there last year. (Source: CNBC).

Government has rolled out PLI schemes to increase value addition in India. For e.g. ratio of domestic value addition in air-conditioners for Panasonic India has gone up from 25 to 45% in about year and half. The target is to take this to 75%,(Source: here).

Similarly, PLI schemes have been announced in 14 key sectors with a total outlay of 1.97 lakh crores (US$26bn). These span sectors like mobile manufacturing, food products, auto components, and drones amongst others. (Source: PIB). Govt is continuously examining and expanding the PLI schemes to enhance domestic manufacturing.

No, the fund is offered as one of the fund options in our select ULIPs. Our PNB MetLife Bharat Manufacturing Fund is available with PNB MetLife Goal Ensuring Multiplier, PNB MetLife Smart Platinum Plus, PNB MetLife Capital Guarantee Plus and PNB MetLife Mera Wealth Plan.

NAV is Net Asset Value. This is the rate at which units are allocated basis the fund you have chosen in your policy.

The aforesaid article presents the view of an independent writer who is an expert on financial and insurance matters. PNB MetLife India Insurance Co. Ltd. doesn’t influence or support views of the writer of the article in any way. The article is informative in nature and PNB MetLife and/ or the writer of the article shall not be responsible for any direct/ indirect loss or liability or medical complications incurred by the reader for taking any decisions based on the contents and information given in article. Please consult your financial advisor/ insurance advisor/ health advisor before making any decision.

PNB MetLife India Insurance Company Limited

Registered office address: Unit No. 701, 702 & 703, 7th Floor, West Wing, Raheja Towers, 26/27 M G Road, Bangalore -560001, Karnataka

IRDAI Registration number 117 | CIN U66010KA2001PLC028883

For more details on risk factors, please read the sales brochure and the terms and conditions of the policy, carefully before concluding the sale.

Tax benefits are as per the Income Tax Act, 1961, & are subject to amendments made thereto from time to time. Please consult your tax consultant for more details.

Goods and Services Tax (GST) shall be levied as per prevailing tax laws which are subject to change from time to time.

The marks "PNB" and "MetLife" are registered trademarks of Punjab National Bank and Metropolitan Life Insurance Company, respectively. PNB MetLife India Insurance Company Limited is a licensed user of these marks.

Call us Toll-free at 1-800-425-6969, Phone: 080-66006969, Website: www.pnbmetlife.com, Email: indiaservice@pnbmetlife.co.in or Write to us: 1st Floor, Techniplex -1, Techniplex Complex, Off Veer Savarkar Flyover, Goregaon (West), Mumbai – 400062, Maharashtra. Phone: +91-22-41790000, Fax: +91-22-41790203.

| Beware of Spurious Phone Calls and Fictitious / Fraudulent Offers! IRDAI or its officials is not involved in activities like selling insurance policies, announcing bonus or investments of premium. Public receiving such phone calls are requested to lodge a police complaint. |

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

As your trusted life insurance partner, PNB MetLife covers COVID-19 claims. In the event of a death claim, please submit a signed claim form mentioning the policy number, a brief description of the insured event, and all other mandatory claim documents to the email addresses provided below. You may write to us at claimshelpdesk@pnbmetlife.com or indiaservice@pnbmetlife.co.in. For death claim intimation or any queries, you can also call us at 1800-425-6969 (for customers calling from within India only), Monday to Saturday, between 10:00 am and 7:00 pm.

PNB MetLife Insurance, amongst the trusted Life Insurance companies in India, aims to provide a wide range of Life Insurance products that suits the needs of an individual at every stage of his life. Life Insurance Plans range from Term Life Insurance Plans, Term Plan, Protection Plans, Long Term Savings Plans , Retirement Plans & Child Education Plan.

Get Trusted Advice

Get Trusted Advice