Parameter |

Nifty Index |

Nifty Small Cap 100 Index |

5 Year Return CAGR |

15.9% |

22.6% |

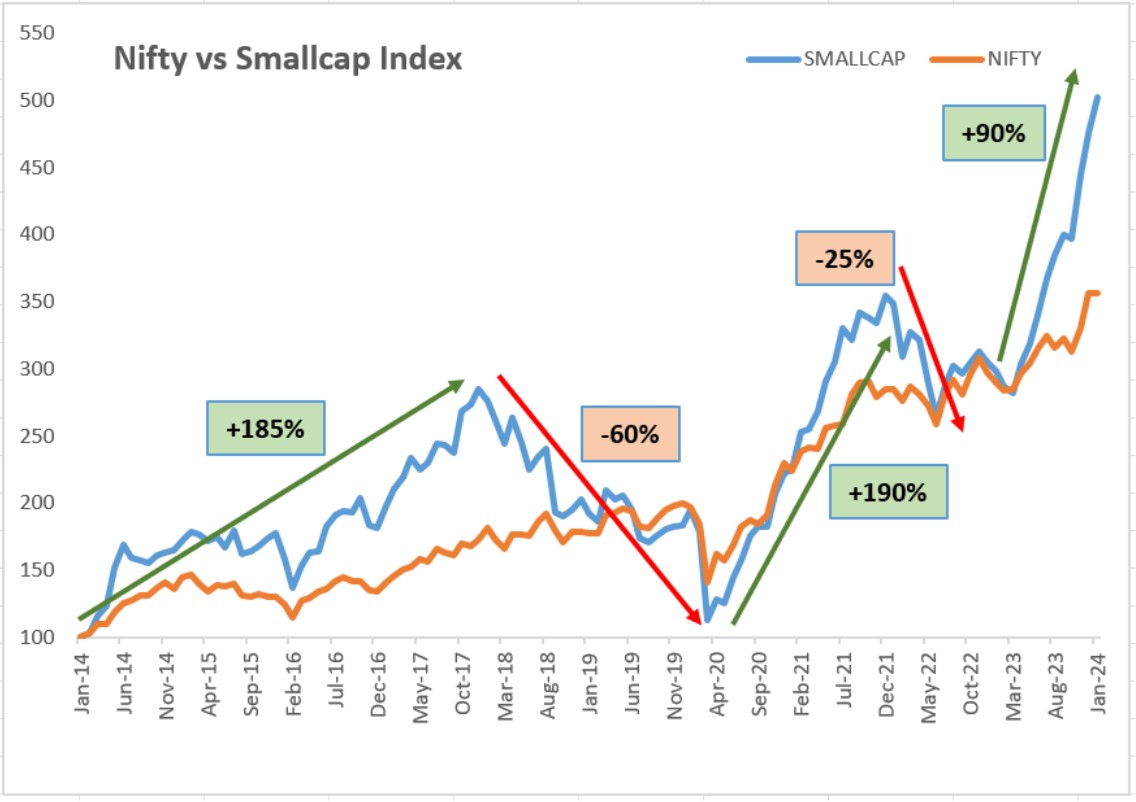

In last five years, Nifty Smallcap 100 Index has provided returns higher than Nifty Index but those are accompanied by higher volatility. Source: SEBI, AMFI data as of 31st Dec 2023, NSE fact sheets as of 31st Jan 2024

As you see above, NIFTY Smallcap 100 index has outperformed Nifty 50 index in the 5-year period, and across different time frames in terms of returns as well. To capitalize on the wealth creation potential offered by small cap universe, PNB MetLife has launched a new fund “PNB MetLife Small Cap Fund”. This is an actively managed, diversified equity fund and will be benchmarked against NIFTY Smallcap 100 index. This fund can be availed with ULIP Plans that combine life insurance with an opportunity to create wealth. We are proud to say that all our funds have consistently performed over a long-term generating healthy returns for our ULIP policyholders. Our newly launched Small Cap Fund aims to provide superior risk-adjusted returns over the long term by investing mainly in small-cap firms with large value creation potential. The growing Indian economy, presents a favorable environment for small-cap equities to thrive and create value for investors.

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

It’s time to realize the potential of Small Caps!

If you had invested about Rs.34,600* p.m for 10 years in NIFTY Smallcap 100 Index (Since Jan’2014), the value of your investment as on (31st Jan’24) would be Rs. 1 Crore^.

| Equity Scheme Name | Cap | 3 Year (CAGR) | 5 Year (CAGR) | Overall Morningstar Rating1 | ||

| NAV Return | Benchmark | NAV Return | Benchmark | |||

| Mid Cap | Mid Cap | 38.20% | 29.00% | 29.70% | 21.60% | ⭐⭐⭐⭐⭐ |

| CREST (Thematic) | Mid Cap | 27.10% | 18.00% | 20.00% | 15.20% | ⭐⭐⭐⭐⭐ |

| Premier Multi-Cap | Mid Cap | 27.00% | 20.30% | 22.30% | 17.00% | ⭐⭐⭐⭐⭐ |

| Multiplier III | Large Cap | 23.80% | 16.80% | 18.50% | 14.90% | ⭐⭐⭐⭐⭐ |

| Flexi Cap | Large Cap | 21.00% | 19.00% | 16.90% | 16.30% | ⭐⭐⭐⭐ |

| Multiplier II | Large Cap | 19.60% | 16.80% | 16.50% | 14.90% | ⭐⭐⭐⭐ |

| Multiplier | Large Cap | 19.10% | 16.80% | 16.10% | 14.90% | ⭐⭐⭐⭐ |

Our New Fund Offer is available at a Net Asset Value of Rs. 10.

No, the fund is offered as one of the fund options in our select ULIPs. Our PNB MetLife Small Cap Fund is available with PNB MetLife Goal Ensuring Multiplier, PNB MetLife Smart Platinum Plus, PNB MetLife Capital Guarantee Plus and PNB MetLife Mera Wealth Plan.

A Small Cap fund invests predominantly in small cap companies. In terms of market capitalization, small caps are the companies ranked 251st onwards (after 100 large cap companies and 150 mid cap companies). The market captalization for small cap companies ranges from approximately Rs. 17000 Cr to Rs 1000cr based on currently available data.

Disclaimer:

The PNB MetLife Small Cap Fund is not a standalone product or fund offered by PNB MetLife, This fund can only be availed to invest into with the purchase of select PNB MetLife ULIP Plans. Please know the associated risks and the applicable charges from your insurance agent or intermediary or policy document issued by us. The past performance of the funds is not indicative of future performance. Unit-linked life insurance products (ULIPs) are different from the traditional insurance products and are subject to risk factors. Premiums paid in unit-linked life insurance policies are subject to investment risks associated with capital markets, and NAVs of the units may go up or down, based on the performance of the fund and factors influencing the capital market and the insured is responsible for his/her decisions. The Unit Linked Insurance Plan such as PNB MetLife Goal Ensuring Multiplier, PNB MetLife Smart Platinum Plus and PNB MetLife Mera Wealth Plans are only the names of the unit-linked life insurance contracts and do not in any way indicate the quality of the contract, their future prospects or returns. The various funds offered under these contracts are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns. Please know the associated risks and the applicable charges from your insurance agent or intermediary or policy document issued by us. The past performance of the funds is not indicative of future performance.

Life Insurance coverage is available with all unit-linked life insurance plans.

The aforesaid article presents the view of an independent writer who is an expert on financial and insurance matters. PNB MetLife India Insurance Co. Ltd. doesn’t influence or support views of the writer of the article in any way. The article is informative in nature and PNB MetLife and/ or the writer of the article shall not be responsible for any direct/ indirect loss or liability or medical complications incurred by the reader for taking any decisions based on the contents and information given in article. Please consult your financial advisor/ insurance advisor/ health advisor before making any decision.

PNB MetLife India Insurance Company Limited Registered office address: Unit No. 701, 702 & 703, 7th Floor, West Wing, Raheja Towers, 26/27 M G Road, Bangalore -560001, Karnataka

IRDAI Registration number 117 | CIN U66010KA2001PLC028883

Terms & conditions apply, Benefits stipulated are subject to premiums paid and policies in-force. For more details on risk factors, please read the sales brochure and the terms and conditions of the policy, carefully before concluding the sale.

Tax benefits are as per the Income Tax Act, 1961, & are subject to amendments made thereto from time to time. Please consult your tax consultant for more details.

Goods and Services Tax (GST) shall be levied as per prevailing tax laws which are subject to change from time to time.

The marks "PNB" and "MetLife" are registered trademarks of Punjab National Bank and Metropolitan Life Insurance Company, respectively. PNB MetLife India Insurance Company Limited is a licensed user of these marks.

Call us Toll-free at 1-800-425-6969, Phone: 080-66006969, Website: www.pnbmetlife.com, Email: indiaservice@pnbmetlife.co.in or Write to us: 1st Floor, Techniplex -1, Techniplex Complex, Off Veer Savarkar Flyover, Goregaon (West), Mumbai – 400062, Maharashtra. Phone: +91-22-41790000, Fax: +91-22-41790203.

1 Funds rated by Morningstar, NAV performance and Morningstar Rating data as of 31st Jan 2024. Within each Morningstar Category, the top 10% of funds receive five stars, the next 22.5% four stars, the middle 35% three stars, the next 22.5% two stars, and the bottom 10% receive one star.

#NAV of Rs. 10/ - will be applicable for duly completed proposals received from 19th to 29th Feb 2024, and issued on 29th Feb 2024. For policies issued after 29th Feb, prevailing NAV on the day of issuance will be applicable. The new fund PNB MetLife Small Cap Fund will be available with all Unit Linked Insurance Products (ULIPs) offered by PNB MetLife and can be availed with effect 19th Feb 2024.

*T&C apply. The calculations are based on index data provided by NSE and exclude any scheme level expenses. PNB MetLife Small Cap Fund (SFIN: ULIFO2819/02/24SMALL- CAPN117) is an actively managed fund with NIFTY Smallcap 100 Index as its benchmark.

^The above illustration shows value of about Rs. 34,600 invested monthly since January 2014 in NIFTY Smallcap100 index, accumulated as of 31st Jan 2024 (a ten year period). For more details or risk factors, please read the sales brochure carefully before concluding a sale.

Beware of Spurious Phone Calls and Fictitious / Fraudulent Offers! |

AD-F/2023-24/1011

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

As your trusted life insurance partner, PNB MetLife covers COVID-19 claims. In the event of a death claim, please submit a signed claim form mentioning the policy number, a brief description of the insured event, and all other mandatory claim documents to the email addresses provided below. You may write to us at claimshelpdesk@pnbmetlife.com or indiaservice@pnbmetlife.co.in. For death claim intimation or any queries, you can also call us at 1800-425-6969 (for customers calling from within India only), Monday to Saturday, between 10:00 am and 7:00 pm.

PNB MetLife Insurance, amongst the trusted Life Insurance companies in India, aims to provide a wide range of Life Insurance products that suits the needs of an individual at every stage of his life. Life Insurance Plans range from Term Life Insurance Plans, Term Plan, Protection Plans, Long Term Savings Plans , Retirement Plans & Child Education Plan.

Get Trusted Advice

Get Trusted Advice