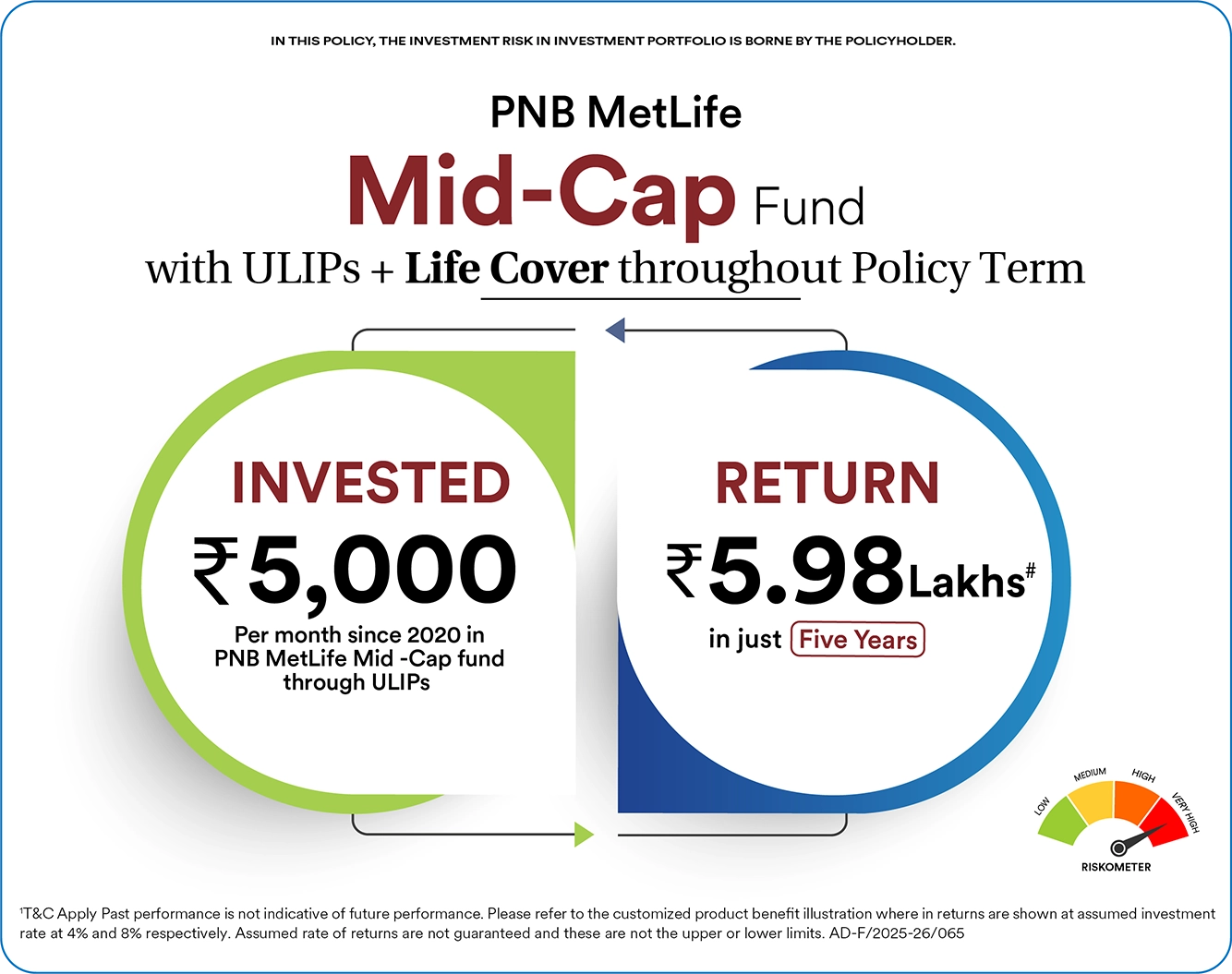

IN THIS POLICY, THE INVESTMENT RISK IN INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDER.

THE UNIT LINKED INSURANCE PRODUCTS DO NOT OFFER ANY LIQUIDITY DURING THE FIRST FIVE YEARS OF THE CONTRACT. THE POLICYHOLDER WILL NOT BE ABLE TO SURRENDER/WITHDRAW THE MONIES INVESTED IN UNIT LINKED INSURANCE PRODUCTS COMPLETELY OR PARTIALLY TILL THE END OF THE FIFTH YEAR.

The past performance of the funds is not indicative of the future performance. Assumed rate of returns are not guaranteed and these are not the upper or lower limits. Unit Linked Life Insurance products are different from the traditional insurance products and are subject to the risk factors. The premium paid in Unit Linked Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/her decisions. PNB MetLife India Insurance Company Limited is only the name of the Life Insurance Company and PNB MetLife Smart Goal Ensuring Multiplier is only the name of the unit linked insurance contract and does not in any way indicate the quality of the contract, its future prospects or returns. Please know the associated risks and the applicable charges, from your Insurance agent or the Intermediary or policy document issued by the insurance company. The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns. The policyholder can know the value of policy wise units as per the FORM D02 through a secured login on the PNB MetLife website (www.pnbmetlife.com)

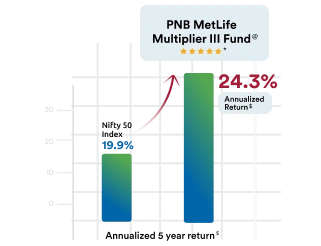

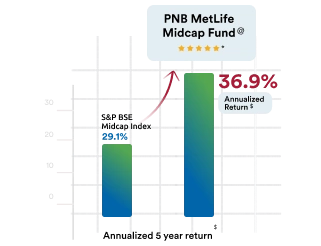

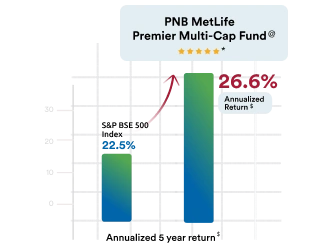

@PNB MetLife Mid Cap Fund SFIN No: ULIF02501/01/18MIDCAPFUND117, PNB MetLife Premier Multi-Cap Fund SFIN No: ULIF02101/01/18MULTICAPFN117, PNB MetLife Multiplier III Fund SFIN No: ULIF01809/10/15MULTIPLIE3117 is not a standalone product and is available for sale with PNB MetLife Unit Linked Insurance Plans Only.

#Zero Tax on ULIP investment up to Rs.2.5 Lakhs Annual Premium, Tax Benefits are as per Income Tax Act 1961, are subject to amendments made there to from time to time, Please consult your tax advisor for more details. Goods and Services Tax (GST) shall be levied as per prevailing tax laws.

*Fund performance and Morningstar Rating data as of 30th June 2025. Within each Morningstar Category, the top 10% of funds receive five stars, the next 22.5% four stars, the middle 35% three stars, the next 22.5% two stars, and the bottom 10% are rated one star. ‘Morningstar, Inc. is a leading provider of independent investment insights in North America, Europe, Australia, and Asia. The Company offers an extensive line of products and solutions that serve a wide range of market participants, including individual and institutional investors in public and private capital markets, financial advisors and wealth managers, asset managers, retirement plan providers and sponsors, and issuers of fixed-income securities. Morningstar provides data and research insights on a wide range of investment offerings, including managed investment products, publicly listed companies, private capital markets, debt securities, and real-time global market data. Morningstar also offers investment management services through its investment advisory subsidiaries, with approximately $328 billion in AUM as of Sept. 30, 2024. The Company operates through wholly-owned subsidiaries in 32 countries. For more information, visit www.morningstar.com/company. Follow Morningstar on X (formerly known as Twitter) @MorningstarInc. © 2024 Morningstar. All rights reserved. The Morningstar name is a registered trademark of Morningstar, Inc. in India and other jurisdictions. The information contained here: (1) includes the proprietary information of Morningstar, Inc. and its affiliates, including, without limitation, Morningstar India Private Limited (“Morningstar”); (2) may not be copied, redistributed or used, by any means, in whole or in part, without the prior, written consent of Morningstar; (3) is not warranted to be complete, accurate or timely; and (4) may be drawn from data published on various dates and procured from various sources and (4) shall not be construed as an offer to buy or sell any security or other investment vehicle. Neither Morningstar, Inc. nor any of its affiliates (including, without limitation, Morningstar) nor any of their officers, directors, employees, associates, or agents shall be responsible or liable for any trading decisions, damages or other losses resulting directly or indirectly from the information.’

$The return shown above is a 5 year annualized return of PNB MetLife Mid Cap Fund, PNB MetLife Premier Multi-Cap Fund & PNB MetLife Multiplier III Fund as on 31st December 2025.

**PNB MetLife started its operations in the year 2001. PNB (established in 1894) and MetLife (established in 1868) are the promoters of PNB MetLife. The combined years of experience/good will /trust of PNB and MetLife is shown in this advertisement.

Disclaimer for banner1 (AD-F/2025-26/895): These are returns of benchmark indices and are not indicative of the return of PNB MetLife Dividend Leaders Index Fund. PNB MetLife Smart Goal Ensuring Multiplier (An Individual, Unit-Linked, Non-Participating, Life Insurance Plan UIN:117L139V02). T&C apply. *The return shown is the 5-year annualised return of the BSE 500 Dividend Leaders 50 Index as on 31st December 2025. PNB MetLife Dividend Leaders Index Fund (SFIN: ULIF03916/01/26DIVIDENDFN117) is an actively managed fund with the BSE 500 Dividend Leaders 50 Index as its benchmark. #NAV of Rs. 10/- will be applicable for duly completed proposals received from 16th to 29th January 2026, and issued on 30th January 2026. For policies issued after 30th January, the prevailing NAV on the day of issuance will be applicable. This fund is suitable for individuals with high risk tolerance and long-term investment goals. Past performance of the fund is not indicative of future performance. Please refer to the customised product benefit illustration, where returns are shown at an assumed investment rate of 4% and 8% respectively. Assumed rate of returns are not guaranteed, and these are not the upper or lower limits. For more details on risk factors, terms & conditions, please read the sales brochure carefully before concluding a sale. PNB MetLife India Insurance Co. Ltd. IRDAI Reg. No. 117.

Disclaimer for banner2 (AD-F/2025-26/901): ^These are returns of the benchmark index and are not indicative of the return of PNB MetLife Dividend Leaders Index Fund. PNB MetLife Smart Goal Ensuring Multiplier (An Individual, Unit-Linked, Non-Participating, Life Insurance Plan UIN:117L139V02). T&C apply. The calculations are based on index data provided by BSE and exclude any scheme-level expenses. PNB MetLife Dividend Leaders Index Fund (SFIN: ULIF03916/01/26DIVIDENDFN117) is a passively managed fund with the BSE 500 Dividend Leaders 50 Index as its benchmark. *The above illustration shows the value of Rs. 5,000 invested monthly since January 2016 in the BSE 500 Dividend Leaders 50 Index, accumulated as of 31st December 2025 (a ten-year period). NAV of Rs. 10/- will be applicable for duly completed proposals received from 16th to 29th January 2026, and issued on 30th January 2026. For policies issued after 30th January, the prevailing NAV on the day of issuance will be applicable. This fund is suitable for individuals with high risk tolerance and long-term investment goals. Past performance of the fund is not indicative of future performance. Please refer to the customised product benefit illustration, where returns are shown at an assumed investment rate of 4% and 8% respectively. Assumed rate of returns are not guaranteed, and these are not the upper or lower limits. For more details on risk factors, terms & conditions, please read the sales brochure carefully before concluding a sale. PNB MetLife India Insurance Co. Ltd. IRDAI Reg. No. 117.

Disclaimer for banner3 (AD-F/2025-26/000): #Zero Tax on ULIP investment up to Rs.2.5 Lakhs Annual Premium, Tax Benefits are as per Income Tax Act 1961, are subject to amendments made there to from time to time, Please consult your tax advisor for more details. Goods and Services Tax (GST) shall be levied as per prevailing tax laws.

Disclaimer for banner4 (AD-F/2025-26/892): ~These are returns of the benchmark index and are not indicative of the return of PNB MetLife Dividend Leaders Index Fund. PNB MetLife Smart Goal Ensuring Multiplier (An Individual, Unit-Linked, Non-Participating, Life Insurance Plan UIN:117L139V02). T&C apply. The calculations are based on index data provided by BSE and exclude any scheme-level expenses. PNB MetLife Dividend Leaders Index Fund (SFIN: ULIF03916/01/26DIVIDENDFN117) is a passively managed fund with the BSE 500 Dividend Leaders 50 Index as its benchmark. *The above illustration shows the value of Rs. 5,000 invested monthly since January 2016 in the BSE 500 Dividend Leaders 50 Index, accumulated as of 31st December 2025 (a ten-year period). ^NAV of Rs.10/- will be applicable for duly completed proposals received from 16th to 29th January 2026, and issued on 30th January 2026. For policies issued after 30th January, the prevailing NAV on the day of issuance will be applicable. This fund is suitable for individuals with high risk tolerance and long-term investment goals. Past performance of the fund is not indicative of future performance. Please refer to the customised product benefit illustration, where returns are shown at an assumed investment rate of 4% and 8% respectively. Assumed rate of returns are not guaranteed, and these are not the upper or lower limits. For more details on risk factors, terms & conditions, please read the sales brochure carefully before concluding a sale. PNB MetLife India Insurance Co. Ltd. IRDAI Reg. No. 117.

PNB MetLife India Insurance Company Limited, Registered address: Unit No. 701, 702 & 703, 7th Floor, West Wing, Raheja Towers, 26/27 M G Road, Bangalore - 560001, Karnataka. IRDAI Registration number 117. CIN: U66010KA2001PLC028883. PNB MetLife Smart Goal Ensuring Multiplier (An Individual, Unit Linked, Non-Participating, Life Insurance Plan, UIN:117L139V02). For more details or risk factors, terms, and conditions, please read the sales brochure before concluding any sale. Tax benefits are as per the Income Tax Act, 1961 & are subject to amendments made there to from time to time. Please consult your tax consultant for more details. Goods and Services Tax (GST) shall be levied as per prevailing tax laws which are subject to change from time to time. Trade Logo displayed above belongs to Punjab National Bank and Metropolitan Life Insurance Company and used by PNB MetLife India Insurance Company Limited under License. Email: indiaservice@pnbmetlife.co.in or Write to us: 1st Floor, Techniplex -1, Techniplex Complex, Off Veer Savarkar Flyover, Goregaon (West), Mumbai 400062, Maharashtra

AD-F/2025-26/916