An Individual, Unit Linked, Non-Participating, Life Insurance Plan | UIN: 117L133V02

Presenting PNB MetLife Goal Ensuring Multiplier (GEM), a solution that provides you with life insurance cover and helps you to invest systematically thereby creating long-term wealth to fulfil your dreams. You can grow your investment with our diverse portfolio of funds that have been consistently performing over the last two decades

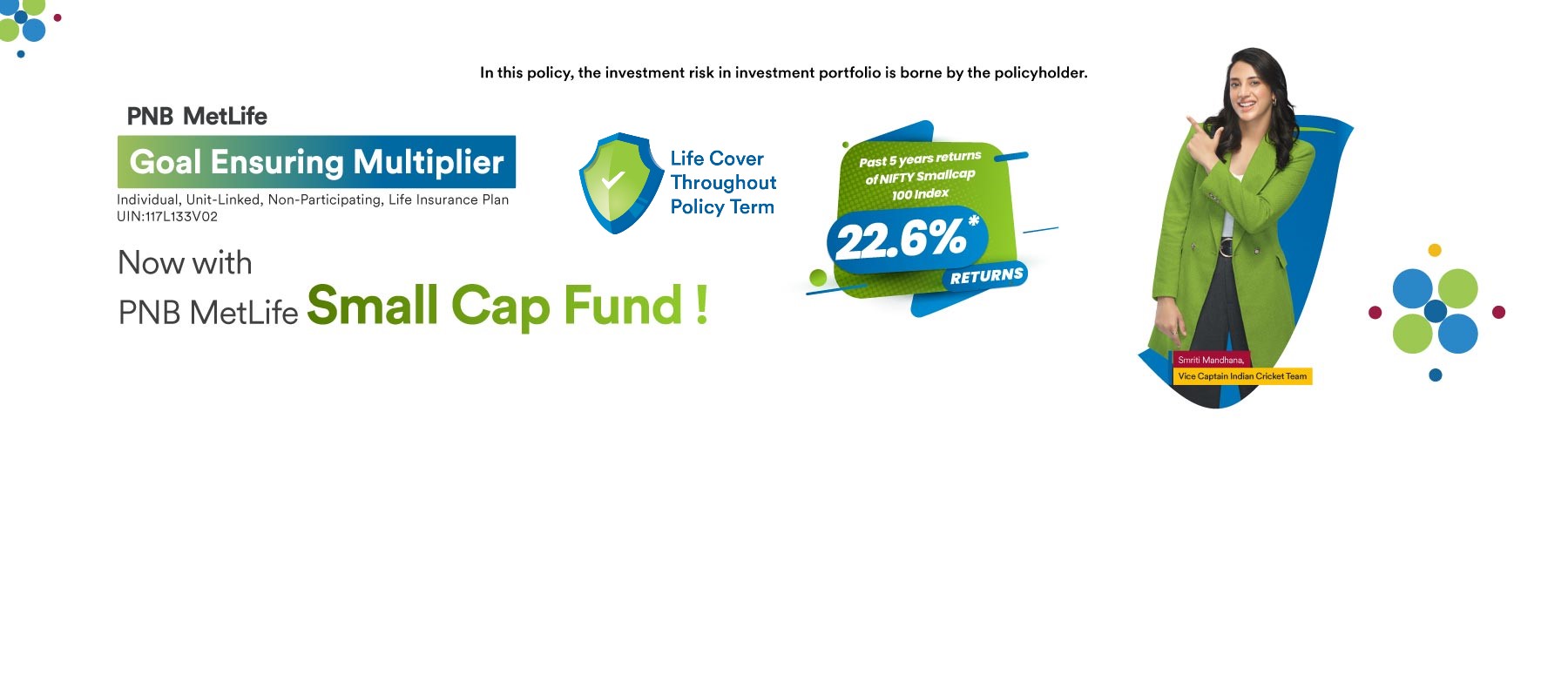

New Fund Offering (NFO)

At PNB MetLife we are delighted to offer a new fund, the “Small Cap Fund”( ULIF02819/02/24SMALLCAPFN117). This fund invests in small businesses that have significant potential for growth. Despite the potentially very high risk, small-cap funds in India are quite popular because to their potential for higher returns. The theory underlying these funds' potential for increased returns is straightforward. A small business has a lot of room to develop and become more successful in the future, so its value might skyrocket in the long run. As a result, experts believe that small-cap fund investments are best suited for individuals with a high risk tolerance and long-term investment goals.

What you don’t get

Suicide Exclusions

In case of death due to suicide within 12 months from the date of commencement of Risk or from the date of revival of the policy, as applicable, the nominee or beneficiary of the policyholder shall be entitled to the Fund Value, as available on the date of intimation of death. Further any charges other than Fund Management Charges (FMC) and guarantee charges recovered subsequent to the date of death shall be added back to the fund value as available on the date of intimation of death. In case of ‘Wealth (Joint Life)’ option, the above clause will be applicable on death due to suicide of either of the lives or both, within 12 months from the date of commencement of the policy or from the date of revival of the policy.

Waiting period

The waiting period is 90 days from the Date of Commencement of Risk or the date of the last Revival of the Policy, whichever is later. Additionally, the Life Assured must survive for a minimum period of 30 days to be eligible for waiver of premium under this benefit.

Exclusions for Critical Illness

No waiver of premium benefit (care benefit) will be payable if the Critical Illness is caused or aggravated directly or indirectly by any of the following acts of the life insured unless those are beyond his / her control. Please refer the sales brochure for complete details.

Choice from below Plan options:

Option 1: Wealth: This option offers accumulated fund value to the policyholder at maturity. If policyholder dies during the policy term, lumpsum benefit will be paid to the nominee.

Additionally Joint life coverage, basis two lives may also be opted under this option

Option 2: Wealth + Care: This option gives life cover to the policyholder along with waiver of premium on specific Critical Illnesses

Option 3: Goal Assured: This option helps secure your goals in times of unforeseen events. In case of death of policyholder, lumpsum benefit will be paid to the nominee along with waiver of any remaining premiums. Additionally, the nominee will receive the accumulated fund value as maturity benefit

Option 4: Income Assured: This option provides additional income to the nominee after death of the policyholder along with lumpsum death benefit on death. Any remaining premiums will be waived off and the nominee shall receive the accumulated fund value at maturity

Option 5: Smart Child: This option offers life insurance cover to policyholder’s child. In case of policyholder’s death, future premiums will be waived off and policy shall continue with risk cover for the child and accumulated fund value will be received at maturity

Please refer to sales brochure for detailed benefit structure

Return of Charges

Create your own wealth plan through a choice of portfolio strategies:

Enhance Your Fund Value:

Get rewarded with fund booster4 at end of 10th, 15th, 20th, 25th & 30th year

| Wealth | Smart Child | Wealth + Care | Goal Assured | Income Assured | |

|---|---|---|---|---|---|

| Minimum Entry Age (Yrs.) | 0 (30 Days) | LA - 0 (30 Days) Policyholder/Proposer – 18 |

18 | ||

| Maximum Entry Age (Yrs.) | Single Life: 60 Joint Life: 55 (Both lives) |

LA - 25 | 60 | 45 | |

| Minimum Policy Term (Yrs.) | Single Life: Joint Life: 10 |

10 | |||

| Maximum Policy Term (Yrs.) | Single Life: Other than Whole Life: 30 Whole Life: 99 Joint Life: 10 |

25 | 20 | ||

| Maximum Maturity Age (Yrs.) | Single Life: Other than Whole Life: 90 Whole Life: 99 Joint Life: 65 |

LA: 50 Proposer: 85 |

85 | 70 | 65 |

| Premium Paying Term | Single Life: Other than Whole Life: Single Pay, Regular Pay, 5 Pay, 7 Pay, 10 Pay Whole Life: Regular Pay, 7 Pay, 10 Pay Joint Life: Single Pay |

Regular Pay, 5 Pay, 7 Pay, 10 Pay | |||

| Minimum Premium | Single Pay: Rs 1,00,000 Minimum Annualized Premium: Rs 18,000 |

||||

| Maximum Premium | No Limit (Subject to Board Approved Underwriting Policy) | ||||

* For the Joint Life coverage, the entry age for any one of the lives should be at least 18 years.

* For the Wealth + Care option, maximum Premium Paying Term will be subject to age of life assured not exceeding 75 years at the end of premium paying term.

* For policies issued to minor lives under Wealth (Single Life) and Smart Child options, the minimum policy term would be subject to the life assured being at least 18 years at the time of maturity of the policy.

* LA denotes Life Assured

On a valid death claim for an in-force policy where all due premiums have been paid, the benefit payable on the death of the Life Assured shall be:

Highest of the following amounts:

In the Goal Assured & Income Assured options, the fund value shall not be considered for death benefit

Plus, the highest of the following amounts

Where Sum Assured is defined as Single Pay/Annualized Premium * Sum Assured Multiple chosen at inception and Top Up Sum Assured is Top Up Premium * 1.25

The Maturity Benefit is the amount payable to the Policyholder or the Nominee(s) on maturity of this policy at expiry of the Policy Term. The Maturity Benefit is equal to the Total Fund Value (including top-up fund value) in the Unit Account determined using the Net Asset Value on the Maturity Date.

The customer shall receive this additional benefit as per the following schedule:

| Premium Paying Term | Fund Booster Percentage | Credit at the End of Policy Year |

|---|---|---|

| Regular Pay, 5 Pay, 7 Pay, 10 Pay | 1% | 15, 20, 25 & 30 |

| Single Pay | 2.4% | 10, 15, 20, 25 & 30 |

Waiver of Premium on Death:

In case of death within the Premium Paying Term for a In Force Policy, any future Installment Premiums that would otherwise have been payable under the Policy shall be waived.

This Benefit is applicable as follows

Waiver of Premium on Critical Illness (Only under Wealth + Care Option):

In case of diagnosis of any one of the following five Critical Illnesses

Disclaimer:

1Return of Fund Management Charges (ROFMC) for Single pay & 5 Pay would be for FMC deducted for first 5 years and for 7 pay & above would be for FMC deducted for first 7 years. This will be credited back at the end of the 10th policy year.

2Return of Premium Allocation Charges (ROPAC) is expressed as percentage of Premium Allocation charges deducted in the policy. The value of ROPAC would be 150% for policies with term greater than or equal to 20 years (paid equally at end of 10th, 15th and 20th policy year), 100% for policy term 15-19 years (paid equally at the end of 10th and 15th year) and 50% for policy term 10-14 years (at the end of 10th year).

3Return of Mortality Charges (ROMC) is expressed as percentage of mortality charges deducted in the policy (net of any taxes). ROMC is not available for Single Pay.

4Tax Benefits under this plan may be available as per the provisions and conditions of the Income Tax Act, 1961 and are subject to any changes made in the tax laws in future. Please consult your tax advisor for advice on the availability of tax benefits for the Premiums paid and proceeds received under the policy for more details.

5Waiver of Premium on death is available in Smart Child, Goal Assured & Income Assured options and Waiver of Premium on critical illness is available in Wealth + Care option.

6For Regular Pay, 5 Pay, 7 Pay & 10 Pay: Fund Booster at the end of 15th, 20th, 25th & 30th years. For Single Pay: Fund Booster at the end of 10th, 15th, 20th, 25th & 30th years

# NAV of Rs. 10/ - will be applicable for duly completed proposals received from 19th to 29th Feb 2024, and issued on 29th Feb 2024. For policies issued after 29th Feb, prevailing NAV on the day of issuance will be applicable. The new fund PNB MetLife Small Cap Fund will be available with all Unit Linked Insurance Products (ULIPs) offered by PNB MetLife and can be availed with effect 19th Feb 2024.

*The return shown is 5 years annualized return of NIFTY Small Cap 100 Index as of 31/1/2024. PNB MetLife Small Cap Fund (SFIN:ULIFO2819/02/24SMALLCAPFN117) is an actively managed fund with NIFTY Small Cap 100 Index as its benchmark.

AD-F/2023-24/989

RELATED PRODUCTS

As your trusted life insurance partner, PNB MetLife is with you amidst the current COVID-19 outbreak. Our policies also cover COVID-19 Claims. In case of a Death Claim, kindly submit the signed Claim Intimation Letter mentioning the policy number, brief of the insured event and other claim documents on the email mentioned herewith. Please write-in to us at claimshelpdesk@pnbmetlife.com or indiaservice@pnbmetlife.co.in. You can also call us on 1800-425-6969 for death claims intimations and for any queries on Monday - Saturday between 10:00 am - 7:00 pm.

PNB MetLife Insurance, amongst the trusted Life Insurance companies in India, aims to provide a wide range of Life Insurance products that suits the needs of an individual at every stage of his life. Life Insurance Plans range from Term Life Insurance Plans, Term Plan, Protection Plans, Long Term Savings Plans , Retirement Plans & Child Education Plan.

Get a Callback

Get a Callback